Accidents can strike without warning—on the road, at work, or even during a routine day at home. While health insurance may help with hospital bills and life insurance supports your family after death, neither fully covers the financial impact of sudden, unexpected injuries. That’s where personal accident insurance steps in. It provides targeted protection against the costs associated with accidental injuries, disabilities, and death, ensuring you’re not left financially vulnerable. In this article, we’ll explore what personal accident insurance is, what it covers, and how it complements both health and life insurance to offer a more complete safety net for you and your loved ones.

What is Personal Accident Insurance?

Personal accident insurance is a specialized insurance policy designed to provide financial compensation in the event of injury, disability, or death caused by an accident. Unlike health insurance, which covers medical treatments for a range of illnesses and conditions, or life insurance, which pays out upon natural or accidental death, personal accident insurance specifically covers incidents resulting from unexpected accidents. Whether it’s a minor injury like a fracture or a major event leading to permanent disability or death, the policy offers a lump sum or regular payments to the insured or their family. This targeted coverage ensures that individuals and their dependents are financially supported during recovery or after a tragic loss, helping them manage expenses without depleting savings.

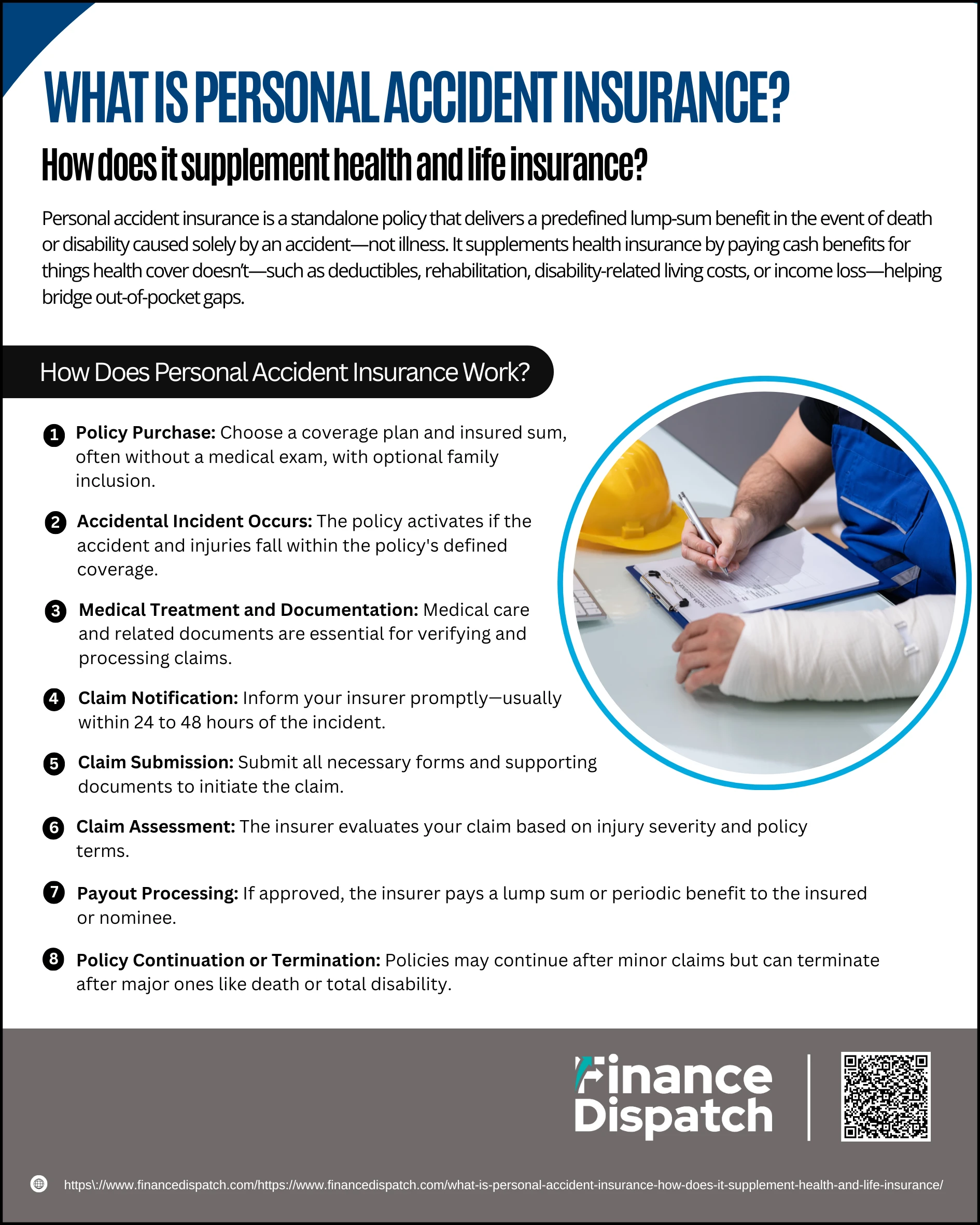

How Does Personal Accident Insurance Work?

How Does Personal Accident Insurance Work?

Personal accident insurance is designed to provide swift financial relief when life takes an unexpected turn due to an accident. Unlike general health or life insurance, which may have broader or long-term coverage, this type of insurance focuses specifically on accidents—offering compensation for injuries, disabilities, or even death resulting from unforeseen events. Whether it’s a minor mishap leading to a fracture or a severe accident causing long-term disability, personal accident insurance steps in to ease the financial burden. To truly understand its value, let’s break down how it works—from buying the policy to receiving a payout.

1. Policy Purchase

The first step is choosing a suitable personal accident insurance plan. You’ll select a “sum insured” (also called Principal Sum) that determines the payout amount in case of a claim. Premiums are typically low, and many policies don’t require a medical exam. Coverage can be extended to your spouse and children under a family plan.

2. Accidental Incident Occurs

When an accident happens, whether it’s a slip, fall, car crash, or workplace injury, the policyholder becomes eligible for benefits if the event falls under the policy’s coverage. The nature and severity of the injury determine the type and amount of compensation.

3. Medical Treatment and Documentation

After the incident, you should seek immediate medical attention. Save all medical bills, prescriptions, test reports, hospital discharge summaries, and any relevant documents. In certain cases, a police report or witness statement may be required, especially for road or workplace accidents.

4. Claim Notification

Notify your insurer about the accident as soon as possible—ideally within the timeframe stated in the policy (usually 24 to 48 hours). Early notification helps prevent delays and complications during claim settlement.

5. Claim Submission

Submit a detailed claim form along with required documents such as ID proof, medical reports, diagnostic tests, photos (if any), and proof of accident (like FIR or accident reports). Each insurer may have slightly different documentation requirements.

6. Claim Assessment

The insurer reviews the claim and may initiate an investigation, particularly for higher claims or disability benefits. They assess whether the injury is covered under the policy and calculate the payout based on severity—e.g., 100% payout for loss of both limbs, 50% for one eye, etc.

7. Payout Processing

If the claim is approved, the insurer releases the benefit amount. Payments may come as a one-time lump sum or in installments (for temporary disability). For accidental death, the nominee receives the full sum insured.

8. Policy Continuation or Termination

Minor claims (like fractures or temporary disabilities) usually don’t cancel the policy—it remains active for future claims. However, in case of major claims such as accidental death or total permanent disability, the policy may terminate after payout, depending on the terms.

Key Coverage Areas of Personal Accident Insurance

Personal accident insurance offers focused financial protection against the unexpected consequences of accidental injuries. Unlike general health or life insurance, which may exclude certain types of accident-related expenses, this policy is designed to directly support individuals and families when accidents lead to medical treatment, disability, or death. Understanding the key areas covered under personal accident insurance can help you assess its value and ensure you’re adequately protected in high-risk scenarios. Below are the primary coverage areas typically included in most personal accident insurance policies:

1. Accidental Death

Provides a lump-sum payment to the nominee if the insured dies as a direct result of an accident.

2. Permanent Total Disability

Covers complete and irreversible disabilities—such as loss of both limbs, total blindness, or paralysis—that prevent the insured from working again.

3. Permanent Partial Disability

Offers partial compensation for irreversible loss of function or amputation of a single limb, eye, or body part.

4. Temporary Total Disability

Provides weekly or monthly income replacement if the insured is temporarily unable to work due to accident-related injuries.

5. Medical Reimbursement

Covers expenses incurred for emergency treatment, hospital stays, diagnostic tests, surgery, and medications related to the accident.

6. Hospital Cash Allowance

Daily cash benefit for non-medical expenses during hospitalization, such as food, travel, and caregiving support.

7. Ambulance Charges

Reimbursement for transportation to a hospital or trauma center following an accident.

8. Fractures and Burns

Compensation for accidental fractures, burns, or other specified non-fatal injuries as defined in the policy.

9. Rehabilitation Expenses

Coverage for physical therapy, occupational therapy, and home adaptations necessary for recovery from a serious injury.

10. Education Benefits for Children

Financial support for dependent children’s education in case of the insured’s accidental death or total permanent disability.

11. Survivor Benefits

Additional lump sum or support offered to family members in case both spouses are injured or killed in the same accident.

How Personal Accident Insurance Supplements Health and Life Insurance

How Personal Accident Insurance Supplements Health and Life Insurance

Health insurance is primarily designed to cover hospitalization and medical treatment expenses, while life insurance provides financial support to your loved ones if you pass away—either naturally or due to an accident. However, neither of these policies fully addresses the unique financial challenges that follow an accident, such as temporary or permanent disability, income loss, or post-hospital recovery costs. That’s where personal accident insurance becomes a vital supplement. It provides targeted protection that bridges the gaps left by health and life insurance. Whether you’re dealing with fractures, long-term disability, or need support for your family after an accident, this policy ensures you’re not left financially vulnerable. Here’s a closer look at how it enhances the coverage provided by your existing insurance plans:

1. Covers Accident-Specific Risks Not Included in Health Insurance

Health insurance typically focuses on illnesses, surgeries, and treatments. It may not cover scenarios like fractures, dislocations, or long-term disability from an accident unless specifically included. Personal accident insurance directly addresses these events, offering compensation regardless of hospitalization.

2. Provides Disability Benefits Not Offered by Life Insurance

Life insurance only provides a payout if the insured dies. But what if an accident leaves you blind, paralyzed, or amputated? Personal accident insurance pays a lump sum or structured benefit in such cases—helping you afford long-term care, make lifestyle adaptations, or compensate for lost income.

3. Offers Income Support During Temporary Total Disability

If an accident sidelines you from work temporarily, personal accident insurance provides weekly or monthly income replacement. This benefit helps cover essential living expenses—rent, groceries, bills—until you’re able to return to work. Neither health nor life insurance offers this kind of income protection.

4. Adds Lump-Sum Payouts for Accidental Death

In case of accidental death, your life insurance will pay out the sum assured. But personal accident insurance can add an extra layer of financial support by providing an additional lump sum payout to your nominee—ensuring that your family has enough to cover funeral costs, debts, and lifestyle continuity.

5. Reimburses Out-of-Pocket Medical Costs

Health insurance often comes with deductibles, co-payments, or exclusions. Personal accident insurance may reimburse expenses like ambulance charges, prosthetics, rehabilitation therapies, or assistive equipment that health plans don’t always cover in full.

6. Provides Benefits Without Needing a Medical Exam

Many health and life insurance plans require a medical test before approval—especially for older adults or those with pre-existing conditions. Personal accident insurance, in contrast, usually doesn’t demand any medical screening, making it easier to obtain even for high-risk individuals.

7. Protects You Beyond Hospitalization

Recovery doesn’t end at discharge. You may need physical therapy, home renovations (like installing ramps or handrails), or daily help. Personal accident insurance includes rehabilitation and adaptation benefits, helping you resume normal life with fewer financial worries—something most health and life policies don’t cover.

Comparison: Personal Accident Insurance vs Health and Life Insurance

While personal accident insurance, health insurance, and life insurance all serve the purpose of financial protection, they differ significantly in their scope, benefits, and claim triggers. Health insurance primarily addresses medical treatment and hospitalization costs due to illnesses or injuries. Life insurance focuses on providing financial support to your beneficiaries in case of your death—natural or accidental. Personal accident insurance, however, is a specialized policy that covers only accident-related injuries, disabilities, or death, offering direct and swift compensation. Understanding the distinctions between these three types of insurance is crucial for building a comprehensive and balanced protection plan. Below is a comparison to help clarify how they differ and complement each other:

| Feature | Personal Accident Insurance | Health Insurance | Life Insurance |

| Coverage Focus | Accidental injuries, disabilities, and death | Illnesses, diseases, surgeries, and accident-related treatments | Death (natural or accidental), terminal illnesses |

| Claim Trigger | Accident leading to injury, disability, or death | Hospitalization or medical treatment due to illness or injury | Death of the policyholder during the policy term |

| Payout Type | Lump sum or periodic payments based on injury severity | Reimbursement of medical bills or cashless treatment | Lump sum payout to nominee upon death |

| Disability Coverage | Yes — includes partial and total, permanent or temporary | Rarely, and only as add-on riders | No |

| Accidental Death Benefit | Yes — full Principal Sum paid to nominee | No (unless rider added) | Yes |

| Natural Death Coverage | No | No | Yes |

| Medical Examination Required | Usually not required | Often required, especially for comprehensive plans | Required for high-value or long-term plans |

| Premium Cost | Low | Moderate to High depending on coverage | Moderate to High depending on sum insured |

| Hospitalization Requirement | Not mandatory for claim | Mandatory for most claims | Not applicable |

| Renewal Term | Usually annual | Annual or long-term | Long-term (5+ years or lifetime) |

| Tax Benefits (in some countries) | Sometimes available | Yes (under health insurance sections) | Yes (under life insurance sections) |

Who Should Consider Personal Accident Insurance?

Personal accident insurance isn’t just for those in high-risk professions—it’s a valuable financial safety net for anyone exposed to everyday risks. Accidents can happen anytime, whether you’re commuting, working, or simply going about your day. While some people may have partial coverage through health or life insurance, personal accident insurance offers focused protection that ensures you or your family are financially supported in the event of injury, disability, or accidental death. Here are the types of individuals who should strongly consider getting personal accident insurance:

1. Sole Breadwinners

Those who support their entire family financially can benefit greatly from personal accident coverage, as it helps maintain stability if they’re unable to work after an accident.

2. Self-Employed Professionals and Freelancers

Individuals without employer-provided insurance or sick leave benefits can rely on personal accident insurance to cover lost income and recovery costs.

3. Workers in High-Risk Occupations

Construction workers, factory staff, miners, electricians, and others who perform physically demanding or hazardous jobs face a higher chance of work-related accidents.

4. Frequent Travelers and Commuters

People who spend long hours on the road—whether by car, bike, or public transport—are at increased risk of road traffic accidents.

5. Athletes and Outdoor Enthusiasts

Those engaged in physical sports or adventurous activities like hiking, cycling, or climbing can benefit from accident-specific financial coverage.

6. Students and Young Adults

Especially those living away from home or in active lifestyles—an accident can disrupt studies and cause financial strain.

7. Senior Citizens Living Independently

Older adults who remain active and independent may want protection in case of falls or unexpected injuries.

8. Parents with Dependent Children

Having personal accident insurance ensures that children’s education and daily needs are not disrupted if a parent becomes temporarily or permanently disabled.

9. Small Business Owners

Entrepreneurs who depend on their physical ability to run operations need financial backup in case of injury that affects their income or business continuity.

Benefits of Personal Accident Insurance

Benefits of Personal Accident Insurance

Accidents can disrupt life in an instant—physically, emotionally, and financially. Whether it’s a slip at home, a road accident, or a work-related injury, the aftermath can be financially draining. While health insurance may cover treatment and life insurance provides for your family after death, neither offers focused coverage for the wide range of challenges that can follow an accident. That’s where personal accident insurance becomes invaluable. It ensures that you’re not only protected medically but also financially—whether you survive with injuries or your family is left to cope after your passing. Here’s a closer look at the comprehensive benefits of personal accident insurance:

1. Financial Protection After an Accident

Accidental injuries can lead to high medical bills and weeks or even months of lost income. Personal accident insurance provides a lump sum or periodic benefit, helping you or your family manage these sudden costs without dipping into savings or going into debt.

2. Coverage for Permanent and Temporary Disability

If an accident leaves you permanently disabled—like the loss of a limb or eyesight—you receive a payout based on the severity. Even for temporary total disabilities, such as a broken leg that keeps you from working for a while, the policy can pay you weekly income replacement until you recover.

3. Accidental Death Benefit for Your Family

In case of death due to an accident, your nominee receives the full insured amount. This helps your family take care of immediate expenses like funeral costs and provides long-term support for daily living, debts, or children’s education.

4. Medical Reimbursement

Personal accident insurance can cover treatment costs including hospitalization, surgeries, medications, and follow-up care—either as part of the main policy or as an add-on. This helps reduce the burden of unexpected out-of-pocket expenses that may not be fully covered by health insurance.

5. Hospital Cash Allowance

Many policies provide a daily cash allowance for each day you are hospitalized due to an accident. This money can be used for non-medical costs like meals, transport, or support services, making your recovery less financially stressful.

6. Affordable Premiums

Compared to life or comprehensive health insurance, personal accident insurance is usually very cost-effective. You can get significant coverage at a relatively low premium, making it an excellent choice for people looking for affordable financial security.

7. No Medical Check-Up Required

Unlike many other insurance plans, personal accident insurance generally doesn’t require you to undergo a medical exam before purchasing the policy. This simplifies the enrollment process and makes coverage accessible even to those with pre-existing health concerns.

8. Support for Children’s Education

Some personal accident policies include education benefits for dependent children in case the policyholder dies or becomes permanently disabled. These benefits help ensure your children’s schooling continues uninterrupted.

9. Worldwide Coverage

Many plans offer global protection, meaning you’re covered whether an accident happens at home, while traveling, or even abroad for work. This is particularly helpful for people who travel frequently for business or leisure.

10. Peace of Mind

Beyond the financial advantages, the psychological relief of knowing you’re protected against life’s uncertainties is invaluable. Whether you’re recovering from an accident or facing a permanent change, personal accident insurance brings emotional security for you and your loved ones.

Common Exclusions in Personal Accident Policies

While personal accident insurance provides valuable financial protection against unexpected injuries, disabilities, or death caused by accidents, it’s important to understand that not all situations are covered. Like most insurance policies, personal accident plans come with specific exclusions—conditions under which the insurer is not obligated to pay benefits. Knowing these exclusions can help prevent unpleasant surprises during a claim and ensure you have realistic expectations about your coverage. Below are some common exclusions found in most personal accident insurance policies:

1. Pre-existing Conditions

Injuries, disabilities, or complications arising from medical conditions that existed before purchasing the policy are typically not covered.

2. Self-inflicted Injuries

Any injury or harm caused intentionally by the insured, including suicide attempts, is excluded from coverage.

3. War and Civil Unrest

Injuries sustained during war, civil commotion, rebellion, or acts of terrorism are usually not covered under standard personal accident policies.

4. Injuries Under the Influence of Alcohol or Drugs

Accidents occurring while the insured is intoxicated or under the influence of illegal substances are typically excluded.

5. Participation in Hazardous Activities

Injuries sustained while participating in extreme sports or high-risk activities (e.g., skydiving, racing, mountaineering) may not be covered unless explicitly included in the policy.

6. Mental or Psychological Conditions

Psychological trauma, stress-related disorders, or mental illnesses are generally not covered unless specifically mentioned.

7. Aviation-related Incidents

Injuries or death occurring while flying as a pilot, crew member, or in non-commercial aircraft are often excluded.

8. Criminal Acts or Illegal Activities

Injuries sustained while engaging in unlawful acts or attempting to break the law are not covered.

9. Pregnancy or Childbirth

Injuries or complications arising from pregnancy, childbirth, or related medical procedures are usually excluded.

10. Illness or Disease

Conditions caused by illness, infection, or disease (unless resulting from an accident) are not included in personal accident coverage.

Choosing the Right Personal Accident Insurance Plan

Selecting the right personal accident insurance plan is a critical step in ensuring you and your family are financially protected in the event of an unexpected accident. With many policies available, each offering different benefits, limits, and exclusions, it’s important to assess your needs, lifestyle, and risk level before making a decision. A well-chosen plan can provide peace of mind, comprehensive coverage, and meaningful support when it’s needed most. Here are key factors to consider when choosing the right personal accident insurance plan:

1. Assess Your Risk Profile

Consider your daily activities, job nature, and travel habits. High-risk occupations or active lifestyles may require broader or more comprehensive coverage.

2. Determine the Right Sum Insured

Choose a coverage amount that can realistically support your medical expenses, income replacement, and long-term needs in case of disability or death.

3. Check for Disability Benefits

Ensure the policy offers adequate payouts for both temporary and permanent disabilities—partial and total. Look into whether payouts are lump sum or regular income.

4. Look for Family Coverage Options

If you want to include your spouse and children, make sure the plan offers a family coverage option and review the benefit breakdown for dependents.

5. Review Exclusions Carefully

Understand what’s not covered—such as self-inflicted injuries, accidents under the influence, or certain high-risk activities—to avoid future claim issues.

6. Compare Premiums and Benefits

Evaluate multiple plans based on cost versus coverage. A slightly higher premium may be worthwhile if it includes additional benefits like hospital cash or rehabilitation support.

7. Check for Add-On Riders

Some insurers offer add-ons like education grants, funeral expenses, or home modification support. These riders can add valuable protection to your base policy.

8. Understand the Claim Process

Choose insurers with a simple, transparent, and fast claim process. Look for good customer reviews and high claim settlement ratios.

9. Verify Global Coverage (if needed)

If you travel often, consider a policy that offers worldwide protection to ensure you’re covered anywhere.

10. Consider Waiting Periods and Renewal Terms

Be aware of any waiting periods before benefits begin, and make sure the policy is renewable annually or for the duration that suits your needs.

Conclusion

Personal accident insurance plays a crucial role in creating a well-rounded financial safety net. While health insurance handles medical treatments and life insurance supports your family after death, personal accident insurance fills the gap by offering direct compensation for accident-related injuries, disabilities, or death. It ensures that you and your loved ones are not left financially vulnerable in the aftermath of an unexpected mishap. From income support during recovery to education benefits for dependents, this policy provides targeted and timely assistance when it matters most. By understanding its coverage, exclusions, and how it complements other insurance types, you can make informed decisions and choose a plan that truly protects your future.