Life insurance is often seen as a long-term financial safety net, offering protection and peace of mind to policyholders and their families. However, life is unpredictable, and circumstances can change. You might find yourself needing to exit a policy early—whether due to financial emergencies, shifting priorities, or better insurance alternatives. This is where the concept of surrender value becomes important. The surrender value in insurance refers to the amount you can receive from your insurance provider if you choose to terminate your policy before it matures. It offers a way to recover a portion of your investment, but it also comes with trade-offs. In this article, we’ll break down what surrender value really means, when you can access it, and what factors influence the amount you might receive.

What is Surrender Value in Insurance?

Surrender value in insurance refers to the amount of money a policyholder receives from the insurance company when they choose to terminate their life insurance policy before its maturity date. This payout is applicable only to traditional life insurance plans such as whole life or endowment policies that include a savings or investment component. It is not available for term insurance policies, which do not build any cash value. Essentially, the surrender value allows you to recover a portion of the premiums you’ve already paid, adjusted for factors like the duration of the policy, bonuses (if any), and applicable surrender charges. It provides a financial exit option, especially useful in times of need, but also ends all future coverage and benefits associated with the policy.

Types of Surrender Value

Types of Surrender Value

When you decide to discontinue your life insurance policy before its maturity, the insurer may offer you a payout known as the surrender value. However, not all surrender values are the same. Depending on your policy type and how long you’ve maintained it, the amount you receive can vary. Broadly, there are two main types of surrender values in life insurance, each calculated differently and influenced by specific conditions.

1. Guaranteed Surrender Value (GSV)

This is the minimum amount you’re entitled to receive when you surrender your policy, provided certain conditions are met—usually after paying premiums for at least two to three consecutive years. The GSV is calculated as a fixed percentage of the total premiums paid, excluding the first-year premium and any premiums for riders or add-ons. The exact percentage increases with the policy duration and is specified in the policy terms.

2. Special Surrender Value (SSV)

Also known as non-guaranteed surrender value, the SSV is usually higher than the GSV and depends on additional factors such as the policy’s paid-up value, bonuses accumulated, and the insurer’s surrender value factor. This value is calculated using the formula:

SSV = (Paid-Up Value + Bonuses) × Surrender Value Factor

The special surrender value becomes applicable if the policyholder stops paying premiums after a certain period, but the policy is kept active as a paid-up policy.

How is Surrender Value Calculated?

Surrender value is not a fixed amount—it varies based on several policy-specific and personal factors. When you choose to exit a life insurance policy before its maturity, the insurer calculates the amount you’re eligible to receive using specific formulas. These calculations depend on the type of surrender value (guaranteed or special), how long the policy has been active, and any bonuses or charges involved. Below are the key components that influence how surrender value is calculated:

1. Type of Surrender Value: Guaranteed Surrender Value (GSV) is calculated as a fixed percentage of the total premiums paid (excluding the first-year premium and any rider premiums), while Special Surrender Value (SSV) considers additional bonuses and is usually higher.

2. Total Premiums Paid: The more premiums you have paid over time, the higher the potential surrender value. However, GSV usually becomes available only after at least two to three years of premium payments.

3. Surrender Value Factor: This is a percentage applied to the calculated paid-up value or premiums and increases with the policy duration. Each insurer sets its own surrender value factor scale.

4. Paid-Up Value: If the policyholder stops paying premiums but doesn’t surrender immediately, the policy may convert into a paid-up policy with a reduced sum assured. This paid-up value becomes a component of the SSV.

5. Accrued Bonuses: For participating policies, any reversionary or terminal bonuses added to the policy are included in the SSV calculation.

6. Policy Term and Age of Policyholder: Longer policy terms and younger ages at policy start typically yield higher surrender values, especially when compounded with bonuses.

7. Surrender Charges: Some policies may deduct a fee or penalty upon surrender, especially in the early years. These charges reduce the final amount paid to the policyholder.

When Can Policyholders Access Surrender Value?

When Can Policyholders Access Surrender Value?

The surrender value of a life insurance policy isn’t available from day one. Most policies require the policyholder to stay invested for a minimum period before becoming eligible for any payout upon surrender. This is done to ensure the policy accumulates sufficient value and to discourage early exits, which may disrupt the policy’s long-term financial planning goals. The specific timing depends on the type of insurance plan, how premiums are paid, and whether bonuses or investment returns are involved. Understanding when you can access the surrender value helps in making informed decisions during financial planning or emergencies.

Here are the key situations in which policyholders can access the surrender value:

1. Completion of the Lock-In Period

Most traditional life insurance policies—like endowment or whole-life plans—require a lock-in period of 2 to 3 years. You must pay premiums for this minimum term before your policy acquires any surrender value. Policies surrendered before this period generally offer no payout.

2. Single-Premium Policies

For single-premium plans, where the entire premium is paid upfront, the surrender value may become available after just one year. These policies tend to offer more immediate liquidity but might still involve early exit charges.

3. Paid-Up Policies After Discontinuing Premiums

If you stop paying premiums after meeting the minimum payment period, the policy can convert into a paid-up policy. While coverage continues with a reduced sum assured, you become eligible to surrender the policy and access a special surrender value at any time after this conversion.

4. ULIP Policies (Unit-Linked Insurance Plans)

ULIPs have a mandatory five-year lock-in period. If you surrender the policy before five years, the fund value is transferred to a low-interest “discontinued policy fund,” and the amount is paid only after the lock-in period ends.

5. Insurer-Specific Terms and Flexible Plans

Some limited-pay or flexible policies may allow earlier access to the surrender value based on specific conditions, such as a higher sum assured or longer policy terms. However, early surrender usually means lower returns due to the deduction of surrender charges and unearned bonuses.

Factors Influencing Surrender Value

The surrender value of a life insurance policy is not a flat amount—it varies based on multiple elements tied to your policy terms and personal circumstances. Insurance providers use a combination of factors to determine how much money you’ll receive if you choose to exit the policy early. Understanding these influencing factors is essential to help you assess whether surrendering your policy makes financial sense and to estimate how much you might actually receive.

Here are the key factors that influence the surrender value:

1. Policy Term

The longer your policy has been active, the higher the surrender value tends to be. Policies that have run for many years accumulate more value due to premiums paid and bonuses earned.

2. Number of Premiums Paid

Regular and consistent premium payments increase the total amount eligible for surrender. Policies with only a few premiums paid typically offer lower surrender values or none at all.

3. Type of Insurance Policy

Traditional plans like endowment or whole-life policies typically build up cash value over time. Term insurance policies, on the other hand, do not accumulate surrender value as they lack a savings component.

4. Surrender Value Factor

This is a percentage determined by the insurer that increases as the policy matures. It’s applied to calculate both guaranteed and special surrender values.

5. Accrued Bonuses

Participating policies may include reversionary and terminal bonuses, which add to the surrender value. The more bonuses accrued, the higher the payout at surrender.

6. Age and Health of the Policyholder

Policies taken at a younger age often have higher surrender values as they allow more time for value accumulation. Riders based on health may also influence bonus components.

7. Surrender Charges or Penalties

Early exits from policies may attract charges that reduce the payout. These charges tend to diminish as the policy ages or may be waived after a certain term, as per IRDAI guidelines.

8. Fund Performance (for ULIPs)

In Unit-Linked Insurance Plans, surrender value is tied directly to the market performance of the investment funds selected. High-performing funds can result in higher surrender values.

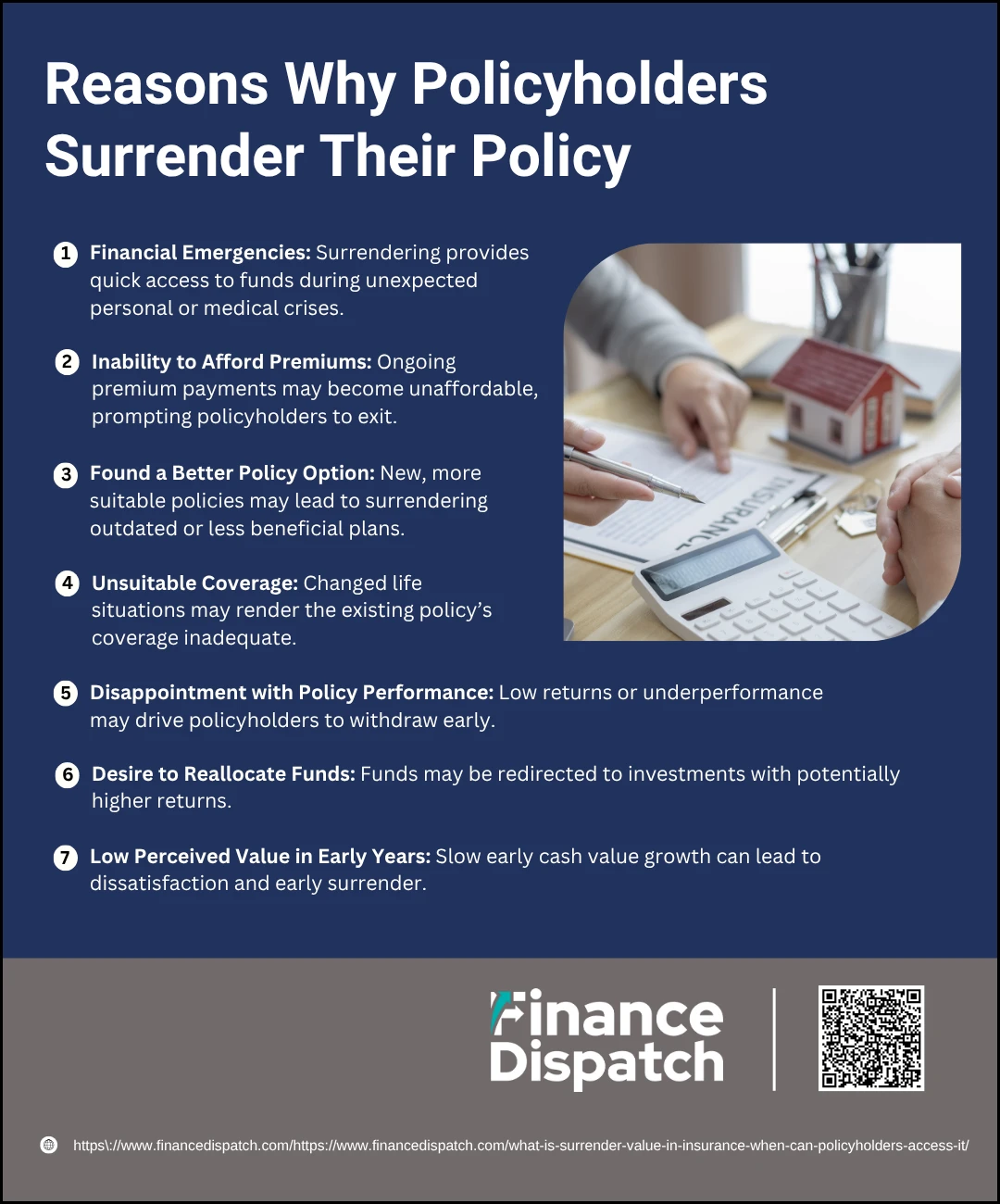

Reasons Why Policyholders Surrender Their Policy

Reasons Why Policyholders Surrender Their Policy

Surrendering a life insurance policy is a significant financial decision that often comes after careful thought—or sometimes out of necessity. While these policies are designed to offer long-term security and maturity benefits, life circumstances don’t always allow policyholders to see them through to completion. Whether due to unexpected hardships, evolving financial goals, or dissatisfaction with policy performance, surrendering a policy provides a way to regain some liquidity, albeit with trade-offs. Understanding the common reasons behind such decisions can help you evaluate whether surrendering is truly in your best interest.

Here are the most frequent reasons why policyholders choose to surrender their life insurance policy:

1. Financial Emergencies

Life is unpredictable, and emergencies can strike when least expected. Whether it’s a medical crisis, job loss, or urgent home repairs, many people turn to their life insurance policy as a source of emergency funds. The surrender value, while not always large, can provide much-needed cash during a financial crunch.

2. Inability to Afford Premiums

Long-term premium commitments can become difficult to maintain—especially in times of economic instability or personal income loss. When premium payments begin to strain monthly budgets, surrendering the policy might seem like the only practical way out, especially if the alternative is letting the policy lapse with no value recovered.

3. Found a Better Policy Option

As the insurance market evolves, new policies often offer better features, lower costs, or more tailored benefits. Policyholders may find that their current plan no longer aligns with their current life stage or financial strategy. Surrendering the old policy allows them to switch to one that better meets their updated needs.

4. Unsuitable Coverage

Over time, people’s insurance needs change. What seemed like sufficient coverage when the policy was purchased may no longer be adequate due to life events such as marriage, having children, or increased financial responsibilities. In such cases, the existing policy may be surrendered in favor of one with a more appropriate sum assured or flexible terms.

5. Disappointment with Policy Performance

Some policies, especially participating ones or those with investment-linked components, may underperform due to poor market conditions or low bonus declarations. When returns are lower than expected, policyholders may prefer to exit the plan and explore alternative investments with better growth potential.

6. Desire to Reallocate Funds

Instead of locking money into a long-term insurance plan, some individuals may choose to reallocate their funds toward high-return options like mutual funds, stocks, or retirement savings accounts. This is especially common when the insurance policy is seen more as an investment than as protection.

7. Low Perceived Value in Early Years

In many traditional policies, especially endowment plans, the cash value accumulated during the first few years is minimal. Policyholders who are disappointed by the slow buildup of value may feel the policy isn’t worth continuing and opt to surrender while reclaiming a portion of their contributions.

Pros and Cons of Surrendering Your Policy

Surrendering a life insurance policy can be a double-edged sword. On one hand, it offers policyholders a way to access liquid funds, especially in times of financial need. On the other, it may result in the loss of critical long-term benefits, including life coverage and accumulated bonuses. While the surrender value can serve as a financial cushion, the decision to cancel a policy should be based on a thorough evaluation of your current needs and future goals. The table below highlights the key advantages and disadvantages of surrendering a life insurance policy:

| Pros | Cons |

| Immediate Access to Funds | Loss of Life Coverage |

| Provides quick liquidity in emergencies or urgent financial needs. | Once surrendered, the policy no longer offers death benefits to your beneficiaries. |

| Flexibility in Financial Planning | Lower Returns Compared to Maturity |

| Frees up money that can be redirected to other financial goals or investments. | The surrender value is typically lower than the maturity amount, especially in early years. |

| Avoids Further Premium Payments | Surrender Charges or Penalties May Apply |

| You no longer have to commit to ongoing premium payments. | Early termination may come with financial penalties that reduce the payout. |

| Can Reinvest in Higher-Yield Options | Loss of Accrued Bonuses and Tax Benefits |

| Funds can be redirected into higher-return investment instruments. | Bonuses earned may be forfeited; also, surrender may affect previously claimed tax deductions. |

Alternatives to Surrendering a Policy

Surrendering your life insurance policy may seem like the easiest way out when facing financial stress or changing priorities—but it’s not always the wisest move. Terminating your policy early can lead to the loss of valuable benefits, including life cover, bonuses, and potential maturity returns. Fortunately, there are several alternatives that allow you to retain some or all of your policy’s value while easing financial pressure. Exploring these options can help you make a more informed and less costly decision.

Here are some practical alternatives to surrendering your policy:

1. Convert the Policy to a Paid-Up Plan

If you stop paying premiums after the minimum lock-in period, your policy can continue with a reduced sum assured. This way, you retain some life cover without paying further premiums.

2. Take a Loan Against the Policy

Many life insurance policies allow you to borrow up to 80–90% of the surrender value. This gives you access to funds without giving up your policy benefits.

3. Opt for a Partial Withdrawal

If your policy permits, you can withdraw a portion of the policy’s cash value instead of surrendering the whole policy. This maintains your coverage while meeting your financial need.

4. Reduce the Sum Assured or Premium Amount

Some insurers offer the option to revise the sum assured or extend the payment term, thereby lowering your premium obligation while keeping the policy active.

5. Utilize Premium Holidays (if available)

Certain policies offer a “premium holiday” or break in premium payments for a defined period. This can help manage short-term cash flow issues without losing coverage.

6. Switch Funds or Rebalance Portfolio (in ULIPs)

For Unit-Linked Insurance Plans, consider switching to lower-risk funds or reallocating your investments within the plan to improve performance instead of surrendering.

7. Speak to a Financial Advisor

A certified advisor can help evaluate your policy’s potential and compare it with other financial options to ensure that surrendering is truly your best choice.

Conclusion

Surrendering a life insurance policy is a decision that carries long-term financial implications. While it can offer quick access to funds during emergencies or help relieve the burden of ongoing premium payments, it also means giving up the life cover and potential benefits that come with staying invested until maturity. Understanding what surrender value is, how it’s calculated, when it becomes accessible, and what alternatives are available can empower you to make a well-informed choice. Before surrendering, it’s wise to review your current financial situation, future goals, and policy features—or even consult a financial advisor—to ensure that your decision supports your long-term security and peace of mind.