Bitcoin was envisioned as a decentralized digital currency for fast, borderless transactions, but its growing popularity exposed a critical flaw—scalability. With an average of just seven transactions per second and confirmation times often stretching into minutes, Bitcoin’s network struggles to support the volume needed for everyday use. Enter the Lightning Network—a second-layer solution built on top of the Bitcoin blockchain. Designed to enable instant, low-cost transactions through off-chain payment channels, the Lightning Network addresses Bitcoin’s key limitations by drastically improving its speed, reducing transaction fees, and expanding its capacity to handle millions of transactions per second. This innovation marks a significant step toward making Bitcoin a practical medium for daily payments and global commerce.

What is Lightning Network?

The Lightning Network is a second-layer protocol built on top of the Bitcoin blockchain, designed to improve its speed and scalability. Instead of recording every transaction directly on the main Bitcoin network, the Lightning Network allows users to create peer-to-peer payment channels where multiple transactions can occur instantly and off-chain. Only the opening and closing of these channels are recorded on the blockchain, reducing congestion and lowering fees. This structure enables users to send and receive Bitcoin quickly and efficiently, making small, frequent transactions—like buying coffee or tipping online—feasible without overwhelming the main network.

How the Lightning Network Works

How the Lightning Network Works

The Lightning Network transforms how Bitcoin transactions are processed by moving them off the main blockchain, reducing delays and costs. It functions through a system of payment channels—private, two-way connections between users that allow them to conduct multiple transactions without waiting for blockchain confirmations each time. This not only increases transaction speed but also allows for far greater scalability, making Bitcoin more practical for everyday payments.

Here’s a more detailed step-by-step breakdown of how the Lightning Network works:

1. Open a Payment Channel

Two users initiate a transaction by creating a multi-signature Bitcoin wallet that holds funds from both parties. This wallet requires both users’ digital signatures to authorize spending. This setup creates a payment channel and is recorded as an initial transaction on the Bitcoin blockchain.

2. Conduct Off-Chain Transactions

With the channel open, the users can conduct unlimited transactions between themselves. These are not broadcast to the Bitcoin network, but instead are recorded privately within the channel. Every transaction updates the balance of funds held by each party.

3. Route Payments Across the Network

Users don’t need to open a direct channel with everyone they want to transact with. The Lightning Network can route payments through a series of existing channels using a network of nodes, ensuring fast and trustless delivery from sender to receiver—even if they aren’t directly connected.

4. Close the Payment Channel

When the users are done transacting, they agree to close the channel. A final transaction is created that reflects the most recent balance between the two parties. This is then broadcast and recorded on the main Bitcoin blockchain.

5. Blockchain Settlement

Only the opening and closing transactions touch the main Bitcoin blockchain. This means all intermediate transfers happen off-chain, reducing congestion, lowering fees, and enabling millions of transactions per second across the network.

Key Advantages of the Lightning Network

Key Advantages of the Lightning Network

The Lightning Network addresses many of the limitations that have hindered Bitcoin’s ability to function as a fast and efficient medium of exchange. As Bitcoin’s popularity grew, its network became congested, leading to longer confirmation times and rising fees—especially during peak demand. The Lightning Network solves these problems by shifting most transactions off the main blockchain and into secure, user-managed channels. This second-layer solution allows Bitcoin to process a vastly greater number of transactions while maintaining its security and decentralization.

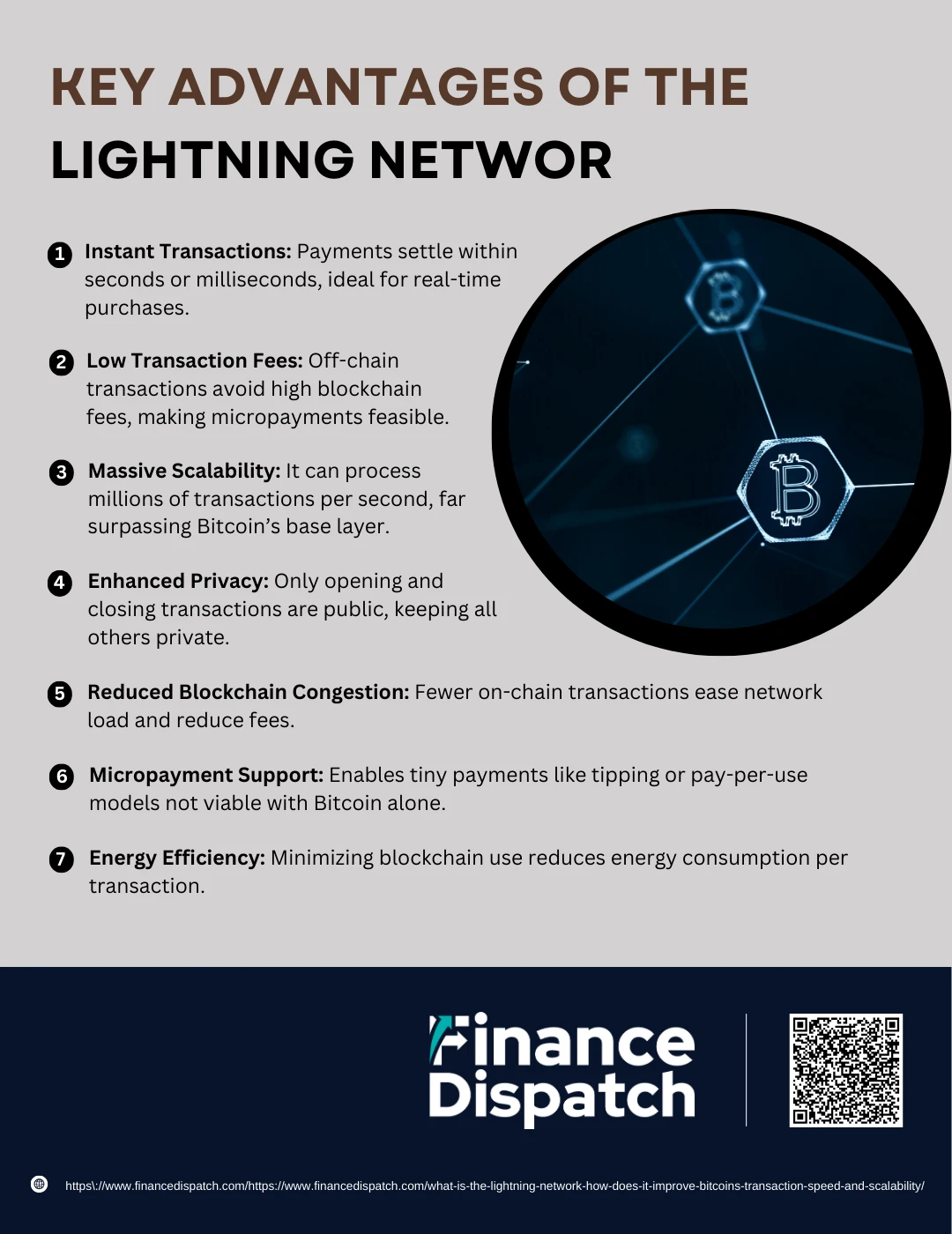

Here are the key advantages of the Lightning Network, explained in more detail:

1 . Instant Transactions

On-chain Bitcoin transactions can take 10 minutes or more to confirm, which isn’t practical for real-time payments. The Lightning Network enables transactions to be settled in seconds—or even milliseconds—making it suitable for everyday use, such as buying a coffee or paying for public transport.

2. Low Transaction Fees

Because Lightning transactions bypass the main blockchain, users avoid paying high miner fees for each payment. Fees on the Lightning Network are minimal, often just a fraction of a cent, which opens the door for cost-effective microtransactions and encourages broader adoption for small, frequent payments.

3. Massive Scalability

Bitcoin’s main chain can handle about 7 transactions per second. The Lightning Network, by comparison, can process millions of transactions per second across thousands of open channels. This allows Bitcoin to scale to meet the needs of a global user base, potentially rivaling traditional payment networks like Visa or Mastercard.

4. Enhanced Privacy

Since Lightning transactions are not recorded on the public blockchain, they are far more private. Only the opening and closing transactions of a payment channel are visible on-chain. All other transfers remain off-chain, shielding details from public view and enhancing user confidentiality.

5. Reduced Blockchain Congestion

With fewer individual transactions hitting the main Bitcoin blockchain, the Lightning Network helps to reduce congestion. This not only lowers fees but also improves the overall performance and reliability of Bitcoin’s core network.

6. Micropayment Support

The Lightning Network supports payments as small as a single satoshi (one hundred-millionth of a Bitcoin), enabling new economic models. These include pay-per-use APIs, pay-per-second video streaming, tipping creators with tiny amounts, and more—use cases that are impossible with traditional Bitcoin transactions due to high fees.

7. Energy Efficiency

Since only two transactions per channel (opening and closing) are written to the blockchain, the Lightning Network significantly reduces the computational power required per transaction. This lowers the energy consumption associated with frequent, small-value transfers and makes Bitcoin more environmentally sustainable.

Real-World Applications of Lightning Network

The Lightning Network has moved beyond theory and is actively powering real-world use cases that highlight its potential to transform how we interact with Bitcoin. By enabling fast, cheap, and scalable transactions, the Lightning Network is unlocking a wide range of applications across industries—from digital content to retail payments and global remittances. Its off-chain model makes it ideal for situations that demand speed, microtransactions, or cost-efficiency.

Here are some of the most impactful real-world applications of the Lightning Network:

1. Micropayments for Digital Content

Users can pay tiny amounts for digital articles, music, videos, or podcasts—perfect for tipping creators or accessing content on a per-use basis.

2. Retail Payments

Businesses can accept instant, low-fee payments for goods and services. This is particularly beneficial for small daily purchases like coffee or snacks.

3. Cross-Border Remittances

The Lightning Network significantly reduces the time and cost of sending money internationally, bypassing banks and intermediaries.

4. Gaming and In-App Purchases

Gamers can make in-game purchases or earn small Bitcoin rewards instantly, enabling real-time incentives and economic systems within games.

5. Streaming Payments

Services can charge users by the second for watching videos, listening to music, or accessing premium content, made feasible by Lightning’s support for continuous, low-cost transactions.

6. Machine-to-Machine (M2M) Payments

In the Internet of Things (IoT), devices such as smart cars or appliances can automatically make payments—for example, paying for tolls, charging stations, or bandwidth usage.

7. Point-of-Sale (POS) Systems

Physical merchants can integrate Lightning payments into their POS terminals, offering customers a fast and modern payment alternative without relying on cards or cash.

8. Online Marketplaces and Platforms

Platforms like online freelance marketplaces can use the Lightning Network to facilitate direct, peer-to-peer payments between users with minimal fees and no middlemen.

How It Improves Bitcoin’s Transaction Speed and Scalability

Bitcoin’s original design prioritizes security and decentralization, but at the cost of speed and scalability. The network processes about seven transactions per second, with each block taking roughly 10 minutes to confirm. This creates bottlenecks during periods of high demand, leading to delays and increased transaction fees. The Lightning Network addresses these limitations by moving the majority of transactions off-chain, allowing users to exchange Bitcoin instantly within secure payment channels. This dramatically increases throughput and reduces strain on the main blockchain, making Bitcoin far more efficient and scalable.

Here’s a comparison table showing how the Lightning Network improves Bitcoin’s performance:

| Feature | Bitcoin (On-Chain) | Lightning Network (Off-Chain) |

| Transaction Speed | ~10 minutes per confirmation | Instant (milliseconds to seconds) |

| Transactions Per Second | ~7 TPS | Up to millions TPS (theoretically unlimited) |

| Transaction Fees | High during network congestion | Very low or negligible |

| Blockchain Load | High—each transaction must be validated | Low—only opening and closing channels are on-chain |

| Energy Consumption | High due to mining and confirmation work | Lower, as fewer transactions are processed on-chain |

| Scalability | Limited by block size and interval | Highly scalable via thousands of payment channels |

Challenges and Limitations of Lightning Network

Challenges and Limitations of Lightning Network

The Lightning Network is often praised as a revolutionary solution to Bitcoin’s scalability and speed issues, but like any emerging technology, it comes with its own set of challenges. While it enables fast, low-cost transactions through off-chain channels, the infrastructure is still maturing. Many of the issues stem from technical complexity, operational friction, and potential security vulnerabilities. Additionally, the network’s architecture, while efficient, raises concerns about decentralization and long-term reliability. Understanding these limitations is crucial before relying on the Lightning Network for widespread or large-scale financial use.

Below are the key challenges and limitations of the Lightning Network explained in greater detail:

1. User Complexity

Unlike traditional payment apps, using the Lightning Network requires a solid understanding of Bitcoin, payment channels, and wallet compatibility. Tasks like opening channels, managing liquidity, and handling routing errors can overwhelm non-technical users. Despite ongoing improvements, user-friendly interfaces are still a work in progress.

2. Liquidity Management

Transactions can only be completed if enough funds are available in the payment channels. Users must allocate and lock up Bitcoin to keep channels funded, which reduces spending flexibility. Balancing liquidity across multiple channels is also difficult, especially for businesses or heavy users.

3. Always-Online Requirement

The Lightning Network depends on both users in a channel remaining online to secure funds and ensure accurate updates. If one party goes offline for too long, the other may attempt a “fraudulent channel close” by broadcasting an outdated balance. While watchtowers (third-party monitors) can help prevent this, they introduce additional layers of complexity.

4. Centralization Risks

As some nodes accumulate many connections and large amounts of liquidity, they begin to act like hubs—similar to traditional financial intermediaries. This undermines Bitcoin’s goal of decentralization and could lead to single points of failure or influence if left unchecked.

5. Security Vulnerabilities

Although Lightning is generally secure, the need for continuous uptime and the risk of channel fraud make it vulnerable, particularly in hostile network conditions. Hacking risks also extend to Lightning-enabled wallets, APIs, and poorly managed nodes.

6. Limited Support for Large Transactions

The Lightning Network is primarily designed for small, fast transactions. Sending large sums can be difficult because the route from sender to recipient must have enough liquidity at each hop. If one channel along the route lacks sufficient funds, the transaction will fail.

7. Regulatory and Legal Uncertainty

The privacy and speed of Lightning payments, while beneficial to users, may draw increased regulatory attention. Authorities may be concerned about off-chain activity bypassing anti-money laundering (AML) and know-your-customer (KYC) regulations. This could result in legal hurdles for exchanges and businesses adopting the technology.

Current Adoption and Future Prospects

The Lightning Network has seen steady growth since its launch, with increasing adoption by individuals, developers, and businesses worldwide. Major cryptocurrency exchanges like Kraken, OKX, and Bitfinex, as well as apps like Cash App and Strike, have integrated Lightning to enable faster and cheaper Bitcoin transactions. Thousands of active nodes and tens of thousands of open payment channels now support the network, handling millions of dollars in capacity. As the technology matures, user-friendly wallets and enterprise solutions are making it more accessible. Looking ahead, future developments like channel factories, multi-path payments, and enhanced privacy protocols aim to improve scalability, liquidity management, and security. With growing interest from financial institutions and fintech startups, the Lightning Network is well-positioned to play a key role in the evolution of Bitcoin as a global, everyday payment system.

Conclusion

The Lightning Network represents a major leap forward in addressing Bitcoin’s long-standing challenges of transaction speed, scalability, and cost. By enabling fast, low-fee, and off-chain transactions, it transforms Bitcoin from a slow and costly network into a practical tool for everyday payments, microtransactions, and global transfers. While the technology still faces hurdles—such as user complexity, liquidity management, and security concerns—ongoing development and growing adoption suggest a promising future. As more users, businesses, and platforms embrace the Lightning Network, it has the potential to redefine how Bitcoin is used, making it not just a store of value, but also a truly scalable medium of exchange.