Withholding tax is a crucial part of every working American’s paycheck, yet many employees aren’t entirely sure what it is or why it’s taken out before they even see their earnings. Essentially, it’s a portion of your income that your employer automatically deducts and sends to the government as an advance on your federal income tax. This system helps ensure that taxes are paid gradually throughout the year, preventing large tax bills during filing season and supporting the government’s “pay-as-you-go” tax model. Understanding how withholding tax works empowers employees to manage their finances more effectively and avoid surprises come tax time.

What Is Withholding Tax?

Withholding tax is the portion of an employee’s wages that an employer deducts from each paycheck and sends directly to the government as a prepayment of income taxes. It serves as a key component of the U.S. pay-as-you-go tax system, ensuring that taxes are collected consistently throughout the year rather than in one lump sum at tax time. This deduction is based on information provided by the employee on IRS Form W-4, including filing status, dependents, and other income or deductions. The withheld amount is later applied as a credit toward the employee’s annual tax liability when they file their return.

How Withholding Tax Works

How Withholding Tax Works

Withholding tax plays a vital role in the U.S. tax system by collecting income tax at the source—directly from an employee’s paycheck—before it even reaches their hands. This system helps taxpayers avoid large, unexpected bills during tax season and ensures the government receives a steady stream of revenue year-round. The amount withheld depends on several factors, including earnings, filing status, dependents, and deductions. Understanding how this process unfolds can help employees manage their finances more effectively and make adjustments if necessary to avoid underpayment or overpayment.

Here’s a breakdown of how withholding tax works:

1. Employee Completes Form W-4

Every new employee must fill out Form W-4 when hired. This form includes details such as marital status, number of dependents, and any additional income or adjustments. These inputs help the employer estimate how much income tax to withhold.

2. Employer Reviews Payroll Details

Employers gather key payroll information, including pay frequency and gross income. This helps determine how often taxes should be withheld and how much to deduct each pay period.

3. Calculation Using IRS Guidelines

Employers refer to IRS Publication 15-T, which includes the latest federal income tax withholding tables. They apply either the Wage Bracket Method or the Percentage Method to calculate the exact amount to withhold from each paycheck.

4. Withholding from Paycheck

Based on the calculation, the employer deducts the correct amount of federal income tax from the employee’s gross wages. This deduction is listed clearly on the employee’s pay stub.

5. Employer Sends Funds to the IRS

The withheld taxes are sent by the employer to the IRS on a regular schedule (typically monthly or semi-weekly). This ensures that the government receives taxes in real-time, rather than waiting for a lump sum during filing season.

6. Year-End Tax Reporting

At the end of the year, employees receive Form W-2 from their employers. This document summarizes their total earnings and the amount of tax withheld. It is used when filing their federal tax return to calculate whether they owe additional taxes or are eligible for a refund.

Types of Withholding Tax

Types of Withholding Tax

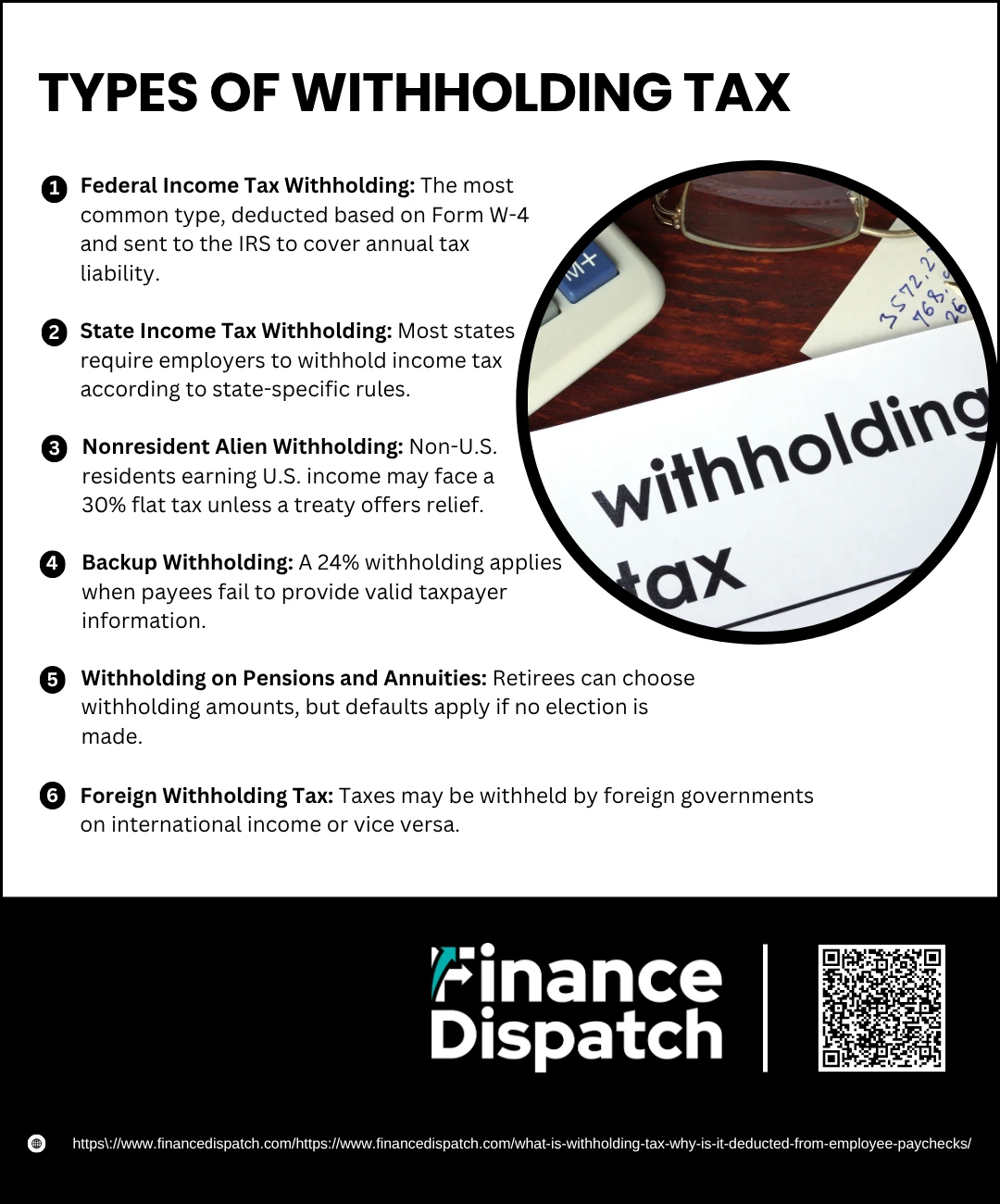

Withholding tax isn’t a one-size-fits-all system. Depending on your residency status, the type of income you earn, or even where you live, different types of withholding tax may apply. Each category serves the same fundamental purpose—ensuring taxes are collected in advance—but the rules, rates, and forms involved can vary. Understanding the main types of withholding tax helps individuals and businesses comply with tax laws and avoid penalties.

Here are the primary types of withholding tax:

1. Federal Income Tax Withholding

This is the most familiar type, deducted directly from employee wages. Employers calculate the amount to withhold based on IRS guidelines and information provided by the employee on Form W-4—such as filing status, number of dependents, and additional income or adjustments. These withholdings are sent to the IRS and count toward the employee’s annual tax liability.

2. State Income Tax Withholding

In most states, employers are also required to withhold income taxes on behalf of the state government. The withholding amount varies depending on the state’s tax rules and the employee’s residency and income. However, some states like Florida, Texas, and Nevada don’t collect state income tax at all, meaning no state-level withholding applies there.

3. Nonresident Alien Withholding

Individuals who are not U.S. citizens or permanent residents but earn income within the U.S. may be subject to nonresident alien withholding. This usually applies at a flat rate of 30% unless modified by a tax treaty between the U.S. and the individual’s home country. It covers wages, dividends, royalties, and other U.S.-sourced income.

4. Backup Withholding

The IRS may require payers to withhold 24% from payments if the payee doesn’t provide a valid Taxpayer Identification Number (TIN) or if the IRS has notified the payer that the recipient is subject to backup withholding due to underreported interest or dividends. This applies to interest, dividends, rent, and other reportable income.

5. Withholding on Pensions and Annuities

Retirement income from pensions and annuities can also be subject to withholding. The recipient can elect how much to withhold, but if they don’t, the payer must follow IRS default rules. These taxes help retirees meet their obligations without a large year-end bill.

6. Foreign Withholding Tax

This occurs when income is earned from another country. For example, if a U.S. resident earns dividends from a foreign investment, the foreign government may withhold a portion before the income is transferred. Likewise, the U.S. withholds tax from payments made to foreign entities or individuals, unless a treaty reduces or eliminates the rate.

Why is Withholding Tax Deducted from employee Paychecks?

Why is Withholding Tax Deducted from employee Paychecks?

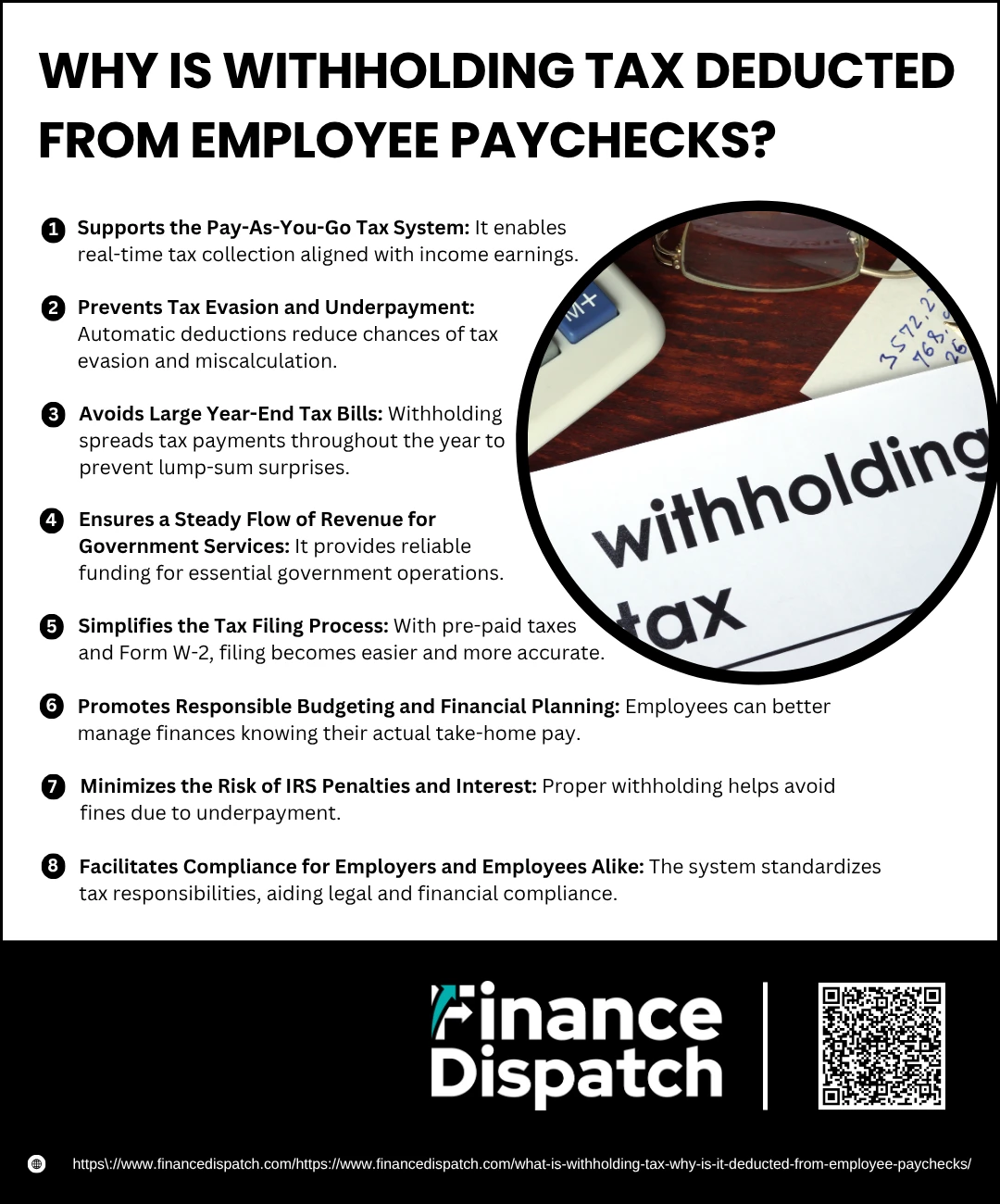

Withholding tax is deducted from employee paychecks as a crucial part of the U.S. tax system designed to promote financial stability, tax compliance, and government efficiency. Rather than requiring individuals to calculate and pay their entire income tax obligation at the end of the year, the withholding system spreads those payments out over time. This ensures that taxes are paid regularly, reducing the risk of underpayment, avoiding sudden financial strain, and guaranteeing that the government receives steady revenue to fund public services. The system also simplifies tax filing for employees by providing records of what has already been paid. Let’s explore in more detail why this deduction happens:

1. Supports the Pay-As-You-Go Tax System

The United States operates on a pay-as-you-go basis, meaning individuals are expected to pay taxes as they earn income. Withholding tax ensures compliance with this system, automatically meeting tax obligations in real-time without requiring the employee to make manual payments each month or quarter.

2. Prevents Tax Evasion and Underpayment

By deducting taxes before employees receive their wages, the system reduces opportunities for tax evasion. It limits the risk of employees forgetting, miscalculating, or intentionally avoiding their tax responsibilities—especially important in a country where millions of wage earners file returns each year.

3. Avoids Large Year-End Tax Bills

Without withholding, employees might find themselves owing thousands of dollars at tax time—money they may not have readily available. Withholding tax protects workers from this burden by gradually collecting what they owe, making tax time less financially disruptive.

4. Ensures a Steady Flow of Revenue for Government Services

Government agencies depend on consistent tax revenue to fund healthcare, education, infrastructure, defense, emergency aid, and countless other services. Withholding provides a dependable, predictable stream of income that helps avoid budget shortfalls or delays in essential services.

5. Simplifies the Tax Filing Process

With taxes already partially paid, employees typically have less to pay (or receive a refund) when filing their annual return. Form W-2, provided by employers, summarizes total earnings and the amount of tax withheld—making it easier to file accurately and efficiently.

6. Promotes Responsible Budgeting and Financial Planning

When withholding is accurately calculated, employees know how much money they’ll actually take home. This transparency allows them to make better decisions about saving, spending, investing, or preparing for life events such as buying a home or having a child.

7. Minimizes the Risk of IRS Penalties and Interest

If you underpay taxes throughout the year, the IRS may charge penalties and interest. Withholding tax reduces this risk, ensuring that enough is paid over time. Even small adjustments—like updating Form W-4 after a life change—can help avoid unexpected tax bills and fines.

8. Facilitates Compliance for Employers and Employees Alike

Employers are required by law to withhold and remit taxes on behalf of their employees. The system is structured to encourage compliance through standardized forms (like the W-4 and W-2), IRS guidance, and payroll tools. This consistency helps businesses avoid legal issues while supporting employees in staying tax-compliant.

How to Calculate Your Withholding Tax

Calculating your withholding tax accurately is essential to avoid owing money at tax time or giving the IRS more than necessary throughout the year. The IRS allows you to estimate your withholding so you can make sure the right amount is being deducted from each paycheck. Whether you’re starting a new job, experiencing a major life change, or just want to double-check your tax situation, following a few key steps can help you calculate your withholding tax with confidence.

Here’s what you need to do to calculate your withholding tax:

- Determine Your Filing Status

Are you single, married filing jointly, married filing separately, head of household, or a qualifying widow(er)? Your filing status influences how much tax is withheld. - Review Your Most Recent Pay Stub

Look at your current wages, federal income tax withheld so far, and your year-to-date earnings to get a snapshot of your income and withholdings. - Gather Your Most Recent Tax Return

This gives you a baseline for your income, deductions, and credits, which will help you make more accurate withholding calculations. - Consider Additional Income Sources

If you or your spouse have a side job, freelance income, or investment earnings, these may not have taxes withheld automatically and need to be accounted for. - Identify Your Deductions

Decide whether you plan to take the standard deduction or itemize. Deductions reduce taxable income and affect how much tax should be withheld. - Account for Tax Credits

Credits such as the Child Tax Credit or education credits directly reduce your tax bill and can influence how much should be withheld. - Use the IRS Tax Withholding Estimator

Visit the IRS website and use their free Tax Withholding Estimator. This tool uses the information you’ve gathered to help you estimate whether your current withholding is on track. - Adjust Your W-4 Form if Necessary

If the estimator shows that you’re under- or over-withholding, you can submit a new Form W-4 to your employer to make corrections.

How to Adjust Your Withholding Tax

Adjusting your withholding tax is a straightforward process that can help you avoid unexpected tax bills or overly large refunds at the end of the year. If you’ve experienced a life change—such as getting married, having a child, starting a second job, or receiving a raise—it’s wise to revisit your tax withholding. To make adjustments, you’ll need to fill out a new IRS Form W-4 and submit it to your employer. This form allows you to update your filing status, claim dependents, report additional income, and specify any extra amount you’d like withheld from each paycheck. The IRS also provides a Tax Withholding Estimator tool online, which can guide you through the process based on your most recent income and tax data. Regularly reviewing and adjusting your withholding ensures that the amount taken from your paycheck aligns closely with your actual tax liability, helping you manage your finances more accurately throughout the year.

Withholding Tax for Independent Contractors

Independent contractors are not subject to traditional withholding tax like regular employees because they are considered self-employed. Instead of having taxes automatically deducted from each paycheck, contractors are responsible for calculating and paying their own taxes through estimated quarterly payments to the IRS. These payments include federal income tax as well as self-employment taxes for Social Security and Medicare. If contractors fail to pay enough throughout the year, they may face penalties or interest at tax time. To stay compliant and avoid surprises, it’s important for independent contractors to track their income carefully, use tools like the IRS Tax Withholding Estimator, and submit estimated taxes by the quarterly deadlines—typically in April, June, September, and January.

Exemptions from Withholding Tax

While most employees are required to have income tax withheld from their paychecks, there are specific situations where individuals may qualify for exemption. Being exempt means no federal income tax will be deducted from your wages, which can increase your take-home pay. However, exemptions are granted only under strict conditions, and filing incorrectly can result in tax penalties. If you believe you meet the criteria, you must submit a completed IRS Form W-4 with the exemption clearly indicated. Here’s what you need to qualify:

1. No Tax Liability in the Previous Year

You must have had zero federal income tax liability for the previous tax year—meaning you owed no taxes and received a full refund of any withheld tax.

2. No Expected Tax Liability in the Current Year

You must reasonably expect to owe no federal income tax in the current year due to low or no taxable income.

3. Correctly File IRS Form W-4

You must write “Exempt” in the designated section of the W-4 form and submit it to your employer to stop federal income tax withholding.

4. Renew Exemption Annually

Exemptions do not automatically carry over year to year. If you remain eligible, you must file a new W-4 each year by February 15 to maintain exempt status.

5. Income Must Not Exceed Filing Thresholds

Your total income must fall below IRS minimum filing requirements for your age and filing status, or you may not qualify for the exemption.

What If Too Much or Too Little Tax Is Withheld?

If too much tax is withheld from your paycheck, the good news is that you’ll likely receive a refund when you file your annual tax return. While getting a refund might feel like a bonus, it actually means you’ve given the government an interest-free loan. On the other hand, if too little tax is withheld, you may owe the IRS money at tax time—and potentially face penalties and interest for underpayment. This usually happens when your W-4 form is outdated or doesn’t reflect recent changes like a new job, raise, or additional income. To avoid either scenario, it’s important to periodically review your withholding using the IRS Tax Withholding Estimator and submit an updated Form W-4 to your employer if needed. Keeping your withholding accurate helps ensure you’re paying the right amount of tax throughout the year, avoiding surprises and making your finances more predictable.

Withholding Tax vs. Other Payroll Deductions

While withholding tax is a key part of your paycheck deductions, it’s not the only one. Employees often see multiple types of deductions on their pay stubs, each serving different purposes. Withholding tax specifically covers income taxes that go to the federal or state government, but other deductions include contributions to Social Security, Medicare, and possibly retirement or health plans. Understanding how withholding tax compares to other payroll deductions can help you better interpret your pay stub and manage your finances.

Here’s a table that highlights the differences:

| Deduction Type | Who Pays It | Purpose | Applies To |

| Federal Income Tax | Employee | Prepayment of federal income tax | All U.S. employees |

| State Income Tax | Employee | Prepayment of state income tax (if applicable) | Employees in most states (except 9 tax-free) |

| Social Security Tax (OASDI) | Employee & Employer | Funds Social Security retirement/disability | Wages up to IRS limit |

| Medicare Tax | Employee & Employer | Funds Medicare healthcare for elderly | All wages; additional 0.9% for high earners |

| FUTA (Unemployment Tax) | Employer | Supports federal unemployment insurance | Employers only |

| SUTA (State Unemployment) | Employer | Supports state unemployment insurance | Employers only (varies by state) |

| Health Insurance Premiums | Employee (voluntary) | Pays for health insurance coverage | If employer offers a plan |

| Retirement Contributions | Employee (voluntary) | Contributes to retirement savings (e.g., 401(k)) | If enrolled in a plan |

Conclusion

Withholding tax plays a critical role in the U.S. tax system, ensuring that income taxes are collected steadily and efficiently throughout the year. By automatically deducting a portion of your paycheck based on your financial profile, it helps prevent surprise tax bills, supports government operations, and simplifies the filing process. Whether you’re an employee or an independent contractor, understanding how withholding works—and knowing when to adjust it—can lead to better financial planning and peace of mind. Staying informed and proactive about your withholding ensures you pay just the right amount of tax—no more, no less.