Collision coverage in auto insurance is a type of optional protection that helps pay for repairs or replacement of your vehicle if it’s damaged in an accident involving another car or a stationary object—regardless of who is at fault. Whether you collide with a mailbox, hit a pothole, or another driver crashes into your parked car, collision insurance can save you from paying thousands of dollars out of pocket. While not legally required, this coverage is often essential for leased or financed vehicles and can provide peace of mind to drivers who want to safeguard their investment. Understanding when collision coverage is most useful can help you decide if it’s the right addition to your auto insurance policy.

What Is Collision Coverage?

Collision coverage is a component of auto insurance that pays for damage to your vehicle resulting from a crash with another vehicle or a stationary object, such as a fence, guardrail, or utility pole. Unlike liability insurance, which only covers damage you cause to others, collision insurance protects your own car—even if you’re found at fault in the accident. This type of coverage typically comes into play in a wide range of scenarios, including rollovers, hit-and-run incidents, or accidents involving uninsured drivers. While it’s not mandated by state law, lenders often require it if you’re leasing or financing your vehicle.

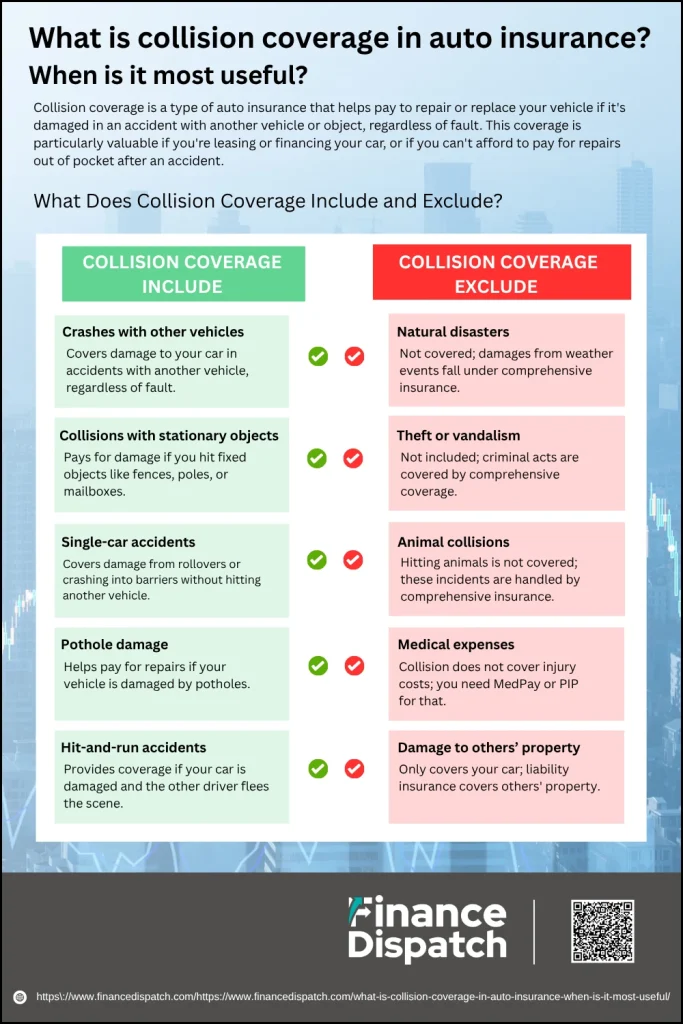

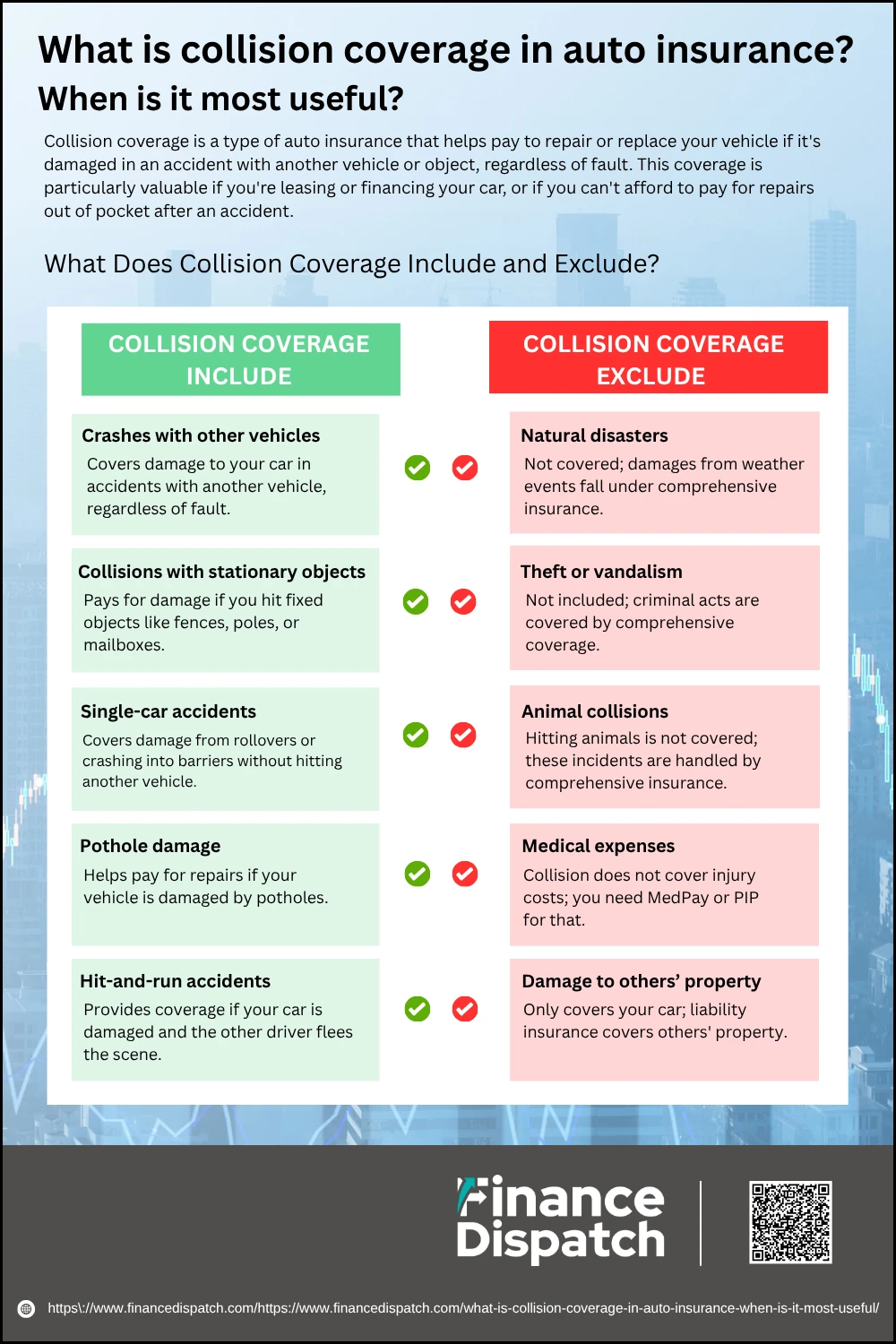

What Does Collision Coverage Include and Exclude?

Collision coverage is a valuable part of auto insurance that helps you cover the cost of repairing or replacing your vehicle after an accident. However, it only applies to certain types of incidents, and understanding the difference between what’s included and what’s excluded can save you time, money, and frustration when filing a claim. Below, we break down the specific scenarios where collision coverage applies—and where it doesn’t.

What Collision Coverage Typically Includes

What Collision Coverage Typically Includes

1. Crashes with other vehicles

If you collide with another moving vehicle—whether you’re driving or parked—collision coverage helps pay for repairs to your own car, regardless of who is at fault. This includes both rear-end accidents and intersection collisions.

2. Collisions with stationary objects

Striking fixed structures like a lamppost, telephone pole, fence, or wall is covered under collision insurance. Even if it’s a simple mistake like backing into a mailbox, your insurer may pay for repairs after the deductible is applied.

3. Single-car accidents

If your vehicle flips over or loses control and crashes into a barrier without hitting another vehicle, collision coverage can step in to cover the damages. These types of accidents are especially common in slippery or adverse driving conditions.

4. Pothole damage

Hitting a pothole and damaging your tires, wheels, or suspension is surprisingly common—and covered by most collision policies. However, it’s still subject to your deductible, so it’s worth comparing repair costs before filing a claim.

5. Hit-and-run accidents

If another driver hits your car and flees the scene, collision insurance can help cover the damages when you can’t identify the other party. This is particularly helpful if you don’t have uninsured motorist property damage (UMPD) coverage.

What Collision Coverage Typically Excludes

1. Natural disasters

Damage from natural events like hailstorms, flooding, earthquakes, or falling trees is not covered under collision insurance. These incidents fall under comprehensive insurance, which handles non-collision-related damage.

2. Theft or vandalism

If your car is stolen or vandalized, collision insurance won’t help. You’ll need comprehensive coverage to be reimbursed for damage or loss due to criminal acts.

3. Animal collisions

If you hit a deer or other animal while driving, this is not considered a collision with a vehicle or object. Instead, it’s classified as an “act of nature” and is typically handled through comprehensive coverage.

4. Medical expenses

Injuries sustained by you or your passengers during an accident aren’t covered by collision coverage. Instead, you would need medical payments (MedPay) or personal injury protection (PIP) coverage, depending on your state’s requirements.

5. Damage to others’ property

Collision insurance only covers your own vehicle. If you’re at fault in an accident and damage someone else’s car or property, liability insurance is the type of coverage that pays for the other party’s loss

How Does Collision Insurance Work?

How Does Collision Insurance Work?

Collision insurance is designed to help you manage the financial burden of car repairs or replacement when your vehicle is damaged in a crash—whether you’re at fault or not. The process begins when you file a claim after an accident and ends when your insurer either pays for the necessary repairs or compensates you for the loss. Understanding each step in this process ensures you’re better prepared in the event of an accident and can make informed decisions about filing a claim.

Step-by-Step Process of Using Collision Insurance

1. Inspect the damage and contact your insurer

After an accident, evaluate your car’s condition. If the damage looks significant or you suspect costly repairs, contact your insurance provider right away. Most companies have 24/7 claims assistance to guide you through the initial steps.

2. File a formal claim

You can typically file a claim via your insurer’s mobile app, website, or phone line. Be ready to provide accident details, including date, time, location, description of the event, and photos or videos of the damage. The more evidence you provide, the smoother the process will be.

3. Insurance adjuster inspects the damage

Your insurer may send an adjuster to physically inspect your vehicle or ask you to bring it to an approved repair facility. The adjuster evaluates the extent of the damage and calculates the estimated repair cost based on labor, parts, and your vehicle’s condition before the accident.

4. Pay your deductible

Collision coverage comes with a deductible—an amount you pay out of pocket before insurance covers the rest. If the repair cost is $4,000 and your deductible is $1,000, your insurer will pay $3,000. The higher your deductible, the lower your monthly premium—but the more you’ll pay in the event of a claim.

5. Receive repairs or compensation

If the vehicle can be repaired, your insurer will either reimburse you or pay the repair shop directly (especially if you use a shop within their network). If your car is deemed a total loss, you’ll receive a payout equal to the actual cash value (ACV) of the vehicle, minus your deductible.

6. Use of optional coverages

If your policy includes optional add-ons like rental car reimbursement, your insurer may pay for a rental while your vehicle is being repaired. If you have roadside assistance, it might cover towing your car to the shop, helping reduce inconvenience and added expenses.

Collision vs. Comprehensive vs. Liability Insurance

Auto insurance policies often include several types of coverage, each serving a specific purpose. Understanding the differences between collision, comprehensive, and liability insurance can help you choose the right protection for your vehicle and financial situation. While all three are important, they cover different scenarios—from crashes to natural disasters to injuries and property damage you may cause to others.

| Coverage Type | What It Covers | Who It Protects | Required By Law? |

| Collision | Damage to your own vehicle from hitting another car or object (e.g., tree, pole) | You and your vehicle | No, but may be required by lenders |

| Comprehensive | Non-collision damage (e.g., theft, fire, vandalism, natural disasters, hitting a deer) | You and your vehicle | No, but often required with collision |

| Liability | Damage you cause to other people’s property or bodily injury in an at-fault accident | Other drivers and their property | Yes, legally required in most states |

When Is Collision Insurance Most Useful?

When Is Collision Insurance Most Useful?

Collision insurance is not legally required, but in many real-life situations, it can be a financial lifesaver. Whether you’re navigating busy city streets, financing a brand-new car, or simply want peace of mind, this type of coverage ensures that accident-related damage to your vehicle won’t leave you with overwhelming repair costs. Below are the scenarios where collision insurance proves most valuable.

1. You’re Financing or Leasing Your Car

If your vehicle is under a loan or lease agreement, the lender or leasing company will almost always require you to carry collision insurance. This ensures their asset—your vehicle—is protected in the event of an accident. Without this coverage, you’d be responsible for paying repair or replacement costs out-of-pocket, even though the car technically isn’t fully yours yet.

2. You Drive a New or High-Value Vehicle

Newer vehicles or cars with high market value can be very expensive to repair or replace after a collision. Collision insurance makes sense in these situations because it helps recoup significant losses. For example, repairing damage to a luxury car could cost thousands, which would be covered after your deductible is met.

3. You Can’t Afford Major Out-of-Pocket Repairs

Even if your car isn’t brand new, collision insurance is a smart investment if paying for sudden repairs would cause financial strain. An unexpected $3,000 repair bill from a minor crash could derail your budget—but with collision coverage, you’d only pay your deductible (often between $250 and $1,000), and the insurer covers the rest.

4. You Drive in High-Risk Areas

Living or commuting in areas with heavy traffic, narrow streets, frequent roadwork, or poor weather conditions increases your chances of a collision. Urban centers, in particular, are known for higher accident rates and fender benders. In such environments, collision coverage adds a crucial layer of protection.

5. You’re a New or Young Driver

Inexperienced drivers, such as teens or individuals who are new behind the wheel, have a statistically higher chance of being involved in an accident. Collision insurance helps cushion the financial consequences of those learning-curve mistakes, which can be very costly without insurance support.

6. You Frequently Commute or Travel Long Distances

The more time you spend on the road, the greater your exposure to risk. Whether you’re commuting to work every day, running frequent errands, or taking long road trips, having collision coverage reduces the worry that comes with increased driving time and exposure to road hazards.

When Might You Skip Collision Coverage?

While collision insurance offers valuable protection, there are cases where it may not be cost-effective to keep. If your vehicle is older and has significantly depreciated in value, the payout from a collision claim—after subtracting your deductible—might not justify the ongoing premium costs. For example, if your car is worth $2,000 and you carry a $1,000 deductible, the most you’d receive in a total loss scenario is $1,000. In such situations, it may make more financial sense to drop collision coverage and set aside savings for potential repairs or replacement. Additionally, if you drive infrequently or your vehicle is stored long-term, the risk of a collision may be low enough that paying for this coverage is unnecessary. Ultimately, the decision to skip collision insurance should be based on your car’s value, your financial readiness to cover accident-related costs, and your individual risk profile.

Cost of Collision Coverage

The cost of collision insurance varies widely based on multiple personal and vehicle-related factors. While it’s typically more expensive than comprehensive coverage, your exact premium depends on how likely insurers believe you are to file a claim—and how much that claim might cost. Understanding what influences your collision coverage rate can help you find opportunities to save without compromising on protection.

Factors That Affect the Cost of Collision Coverage

1. Vehicle make, model, and year

Expensive or newer cars usually cost more to insure because they’re pricier to repair or replace.

2. Your driving history

If you have a clean driving record, you’re likely to pay less. Accidents and traffic violations raise your risk profile.

3. Location

Urban areas or regions with high accident rates and thefts tend to have higher insurance costs than rural areas.

4. Annual mileage

the more you drive, the higher your chances of getting into an accident, which increases your premium.

5. Deductible amount

Choosing a higher deductible (e.g., $1,000 instead of $500) can lower your premium, but you’ll pay more out of pocket in a claim.

6. Bundling and discounts

Bundling your auto policy with other types of insurance (like homeowners or renters) or using insurer-specific discounts can reduce costs.

7. Credit score (in most states)

In many states, insurers use your credit history to determine rates, with better scores typically leading to lower premiums.

Tips to Save on Collision Insurance

Collision insurance can provide essential protection for your vehicle, but that doesn’t mean you have to overpay for it. With a few smart strategies, you can reduce your premium while still maintaining the coverage you need. Below are some practical tips to help you save money on your collision insurance without compromising on quality or peace of mind.

Smart Ways to Lower Your Collision Insurance Costs

1. Raise your deductible

Opting for a higher deductible—like $1,000 instead of $500—can significantly reduce your monthly or annual premium.

2. Bundle insurance policies

Combining auto insurance with other types, such as home or renters insurance, often qualifies you for a multi-policy discount.

3. Maintain a clean driving record

Avoiding accidents and traffic violations helps you qualify for safe driver discounts and keeps your risk level low in the eyes of insurers.

4. Drive a car that’s cheaper to insure

Vehicles with high safety ratings, low repair costs, and minimal theft risk usually come with lower insurance premiums.

5. Limit your mileage

Some insurers offer lower rates to drivers who use their vehicles less frequently or enroll in a usage-based insurance program.

6. Ask about available discounts

Many insurance companies offer discounts for things like being a good student, completing defensive driving courses, or installing anti-theft devices.

7. Shop around and compare quotes

Rates can vary significantly between insurers, so getting multiple quotes ensures you’re not overpaying for the same level of coverage.

Conclusion

Collision coverage is a valuable component of an auto insurance policy that helps protect you financially if your vehicle is damaged in a crash, whether you’re at fault or not. While it’s not legally required, it’s often essential for newer, high-value, or financed vehicles, and offers peace of mind for drivers who want to avoid costly repair bills. By understanding what collision insurance covers, when it’s most useful, and how it compares to other types of coverage, you can make informed decisions about whether to include it in your policy. And with a few strategic choices—like adjusting your deductible or taking advantage of discounts—you can enjoy robust protection without breaking the bank.