In today’s digital economy, Bitcoin has become a widely recognized and valuable asset, but there are times when you might need to convert it into cash. Whether you’re looking to make everyday purchases, lock in profits, or comply with tax regulations, knowing how to seamlessly turn your Bitcoin into traditional currency is essential. Fortunately, there are several reliable methods available, including centralized crypto exchanges, peer-to-peer platforms, Bitcoin ATMs, crypto debit cards, and even gift cards. In this article, you’ll discover the easiest and most efficient ways to cash out your Bitcoin, along with practical tips to help you choose the best option for your needs. Let’s dive in!

Understanding Bitcoin-to-Cash Conversion

Bitcoin, the world’s first decentralized cryptocurrency, has revolutionized the way we perceive and transact value. However, despite its growing acceptance, Bitcoin isn’t universally recognized as a direct payment method, making it essential to know how to convert it into cash when needed. Converting Bitcoin to cash allows you to access traditional financial systems, make everyday purchases, or secure profits during market highs. The process involves exchanging your Bitcoin for fiat currency through methods such as centralized crypto exchanges, peer-to-peer (P2P) platforms, Bitcoin ATMs, crypto debit cards, or even gift cards. Each method offers its own advantages, from convenience and speed to privacy and cost-effectiveness. Understanding the nuances of these options ensures you can choose the most suitable method based on your needs, whether you prioritize speed, low fees, or maximum security.

Popular Methods to Convert Bitcoin to Cash

Converting Bitcoin into cash has become a common necessity for crypto holders, whether for everyday expenses, securing profits, or meeting tax obligations. Fortunately, there are several reliable methods to achieve this, each with its own benefits and considerations. From centralized exchanges to peer-to-peer platforms and Bitcoin ATMs, the options cater to varying needs in terms of speed, fees, and convenience. Below are some of the most popular methods to convert Bitcoin into cash effectively:

1. Centralized Crypto Exchanges (CEXs)

Platforms like Coinbase, Kraken, and Gemini allow you to sell Bitcoin and withdraw fiat currency directly to your bank account. They are user-friendly, secure, and suitable for both beginners and experienced traders.

2. Crypto Debit Cards

Crypto debit cards, such as those from Coinbase or Crypto.com, allow you to spend Bitcoin like regular cash. The card automatically converts your crypto into fiat currency during transactions, making it ideal for everyday purchases.

3. Peer-to-Peer (P2P) Exchanges

P2P platforms, such as LocalCoinSwap or Paxful, connect buyers and sellers directly. These platforms offer flexibility in payment methods and often have lower fees, but require caution to avoid scams.

4. Bitcoin ATMs

Bitcoin ATMs provide a quick way to convert Bitcoin into cash. Simply scan your wallet QR code, transfer your Bitcoin, and withdraw cash. However, high transaction fees are a common drawback.

5. Gift Cards

Platforms like Bitrefill and eGifter let you buy gift cards using Bitcoin, which can then be used for shopping or sold for cash. While not a direct cash-out method, it’s a practical alternative for accessing Bitcoin’s value.

Comparison of Bitcoin-to-Cash Methods

When converting Bitcoin into cash, different methods offer varying levels of convenience, speed, fees, and security. Choosing the right option depends on your priorities—whether it’s minimizing fees, accessing cash instantly, or ensuring maximum privacy. Below is a comparison table highlighting the key differences among the most popular Bitcoin-to-cash conversion methods, helping you make an informed decision.

| Method | Pros | Cons | Fees | Speed | Best For |

| Centralized Exchanges (CEXs) | User-friendly, high liquidity, secure | Identity verification required, potential frozen funds | Trading & withdrawal fees | 1-3 days | Beginners, large transactions |

| Crypto Debit Cards | Convenient for everyday purchases, instant transactions | Limited acceptance, potential fees | Conversion & ATM fees | Instant | Daily spending |

| Peer-to-Peer (P2P) Exchanges | Lower fees, flexible payment methods | Fraud risks, limited liquidity | Maker/Taker fees | Minutes to hours | Privacy-focused users |

| Bitcoin ATMs | Fast, no need for online accounts | High fees, limited availability | 5-20% transaction fees | Minutes | Instant cash access |

| Gift Cards | Access to retail products/services | Limited usability, potential expiry | Conversion fees | Minutes | Shopping and gifting |

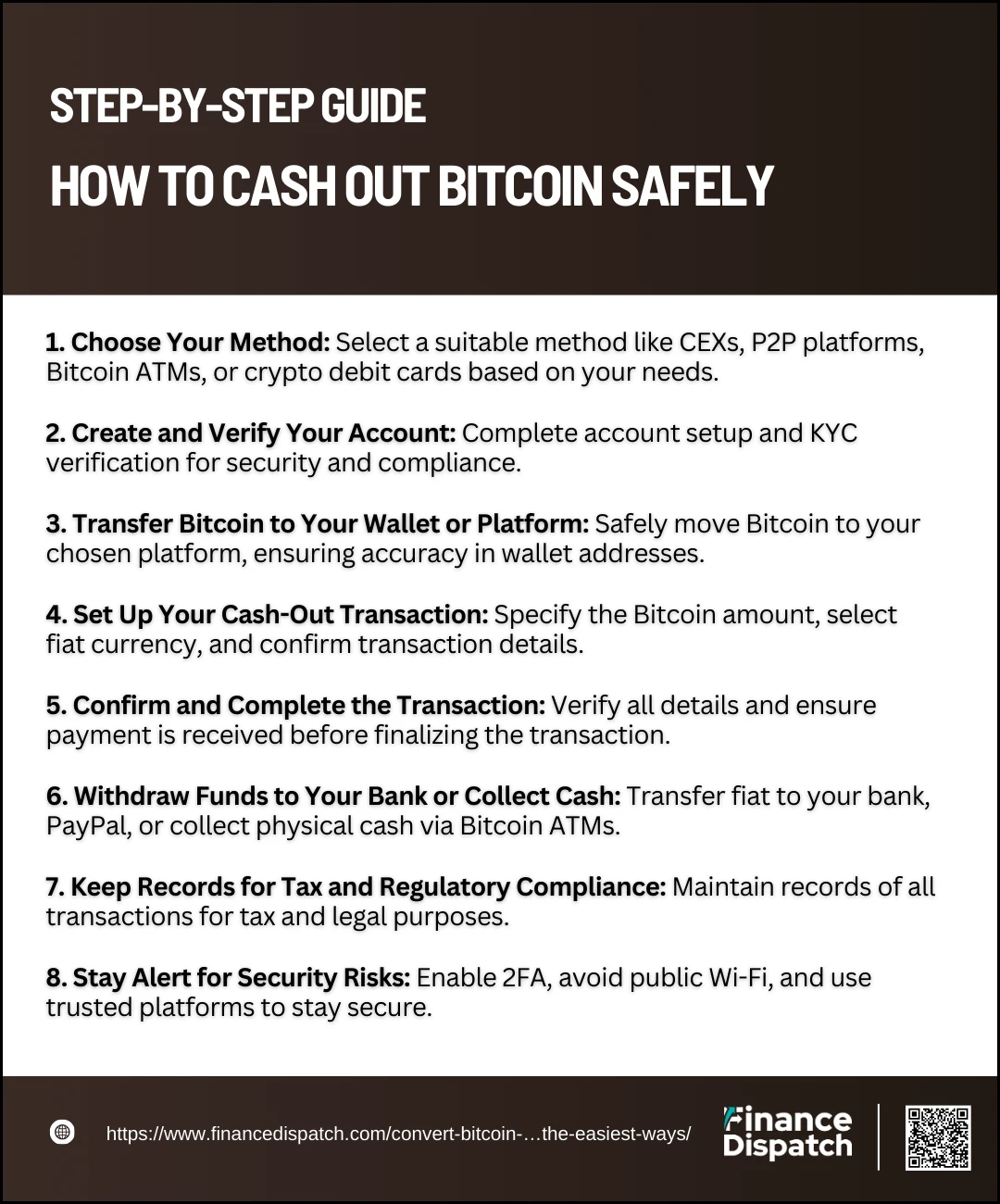

Step-by-Step Guide: How to Cash Out Bitcoin Safely

Cashing out Bitcoin might seem complex at first, but with the right approach, it can be a smooth and secure process. Whether you’re converting Bitcoin to cash for daily expenses, capitalizing on market gains, or complying with financial regulations, safety should always be a top priority. The method you choose—be it through centralized exchanges, peer-to-peer (P2P) platforms, Bitcoin ATMs, or crypto debit cards—depends on factors such as transaction speed, fees, privacy, and convenience. Below is a detailed step-by-step guide to help you navigate the process and ensure a secure Bitcoin-to-cash conversion experience.

1. Choose Your Method

Begin by selecting the most suitable method for cashing out your Bitcoin. Popular options include centralized exchanges (like Coinbase or Kraken) for reliability, P2P platforms (like Paxful or LocalCoinSwap) for flexibility, Bitcoin ATMs for instant cash, or crypto debit cards for everyday spending. Assess factors like transaction fees, processing times, and your comfort level with each method before proceeding.

2. Create and Verify Your Account

If you’re using a centralized exchange or a P2P platform, you’ll need to create an account and complete the Know Your Customer (KYC) verification process. This usually involves submitting identification documents to comply with financial regulations. Verification adds a layer of security and prevents fraud.

3. Transfer Bitcoin to Your Wallet or Platform

Move your Bitcoin from your personal wallet to the platform or service you’ve chosen. Always double-check the receiving address to avoid irreversible mistakes. On P2P platforms, ensure that the escrow service is enabled for added protection.

4. Set up Your Cash-Out Transaction

On your chosen platform, specify the amount of Bitcoin you want to cash out and select your preferred fiat currency (e.g., USD, EUR). For centralized exchanges, execute a sell order. On P2P platforms, find a reputable buyer with positive feedback and agree on payment terms.

5. Confirm and Complete the Transaction

Carefully review all transaction details, including fees, exchange rates, and payment methods, before confirming. For P2P transactions, wait until you’ve received payment from the buyer before releasing the Bitcoin held in escrow.

6. Withdraw Funds to Your Bank or Collect Cash

After completing the sale, withdraw your cash to your bank account, PayPal, or mobile wallet, depending on the payment method used. If you’re using a Bitcoin ATM, follow the on-screen instructions to receive physical cash.

7. Keep Records for Tax and Regulatory Compliance

Always keep transaction records, including receipts, wallet addresses, and payment confirmations. These records are essential for tax reporting and to stay compliant with local cryptocurrency regulations.

8. Stay Alert for Security Risks

Use two-factor authentication (2FA) on your accounts, avoid public Wi-Fi when processing transactions, and only use reputable platforms. Being cautious can protect your funds from fraud and cyber threats.

Tips for Safe and Secure Bitcoin-to-Cash Conversion

Converting Bitcoin to cash is a practical way to access your cryptocurrency’s value, whether for personal expenses, investments, or securing profits. However, the process comes with potential risks, including scams, high fees, and regulatory hurdles. To ensure a smooth and secure transaction, it’s essential to follow best practices and remain cautious throughout the process. Below are key tips to help you convert your Bitcoin to cash safely and securely:

- Use Reputable Platforms: Stick to well-known centralized exchanges, P2P platforms, or Bitcoin ATMs with a track record of security and reliability.

- Enable Two-Factor Authentication (2FA): Always activate 2FA on your exchange or wallet accounts to add an extra layer of security.

- Verify Buyer/Seller Reputation (P2P): On peer-to-peer platforms, deal only with users who have positive reviews and a verified identity.

- Double-Check Wallet Addresses: Ensure the wallet address you’re sending Bitcoin to is accurate before confirming any transaction.

- Beware of Unrealistic Offers: Avoid deals that promise unusually high returns or involve suspicious payment methods.

- Understand Fees and Conversion Rates: Be aware of all fees, including trading, withdrawal, and network charges, before proceeding with the conversion.

- Stay Compliant with Regulations: Follow your country’s legal and tax guidelines related to cryptocurrency conversions.

- Use Escrow Services for P2P Transactions: When trading peer-to-peer, use platforms with escrow services to prevent fraud.

- Avoid Public Wi-Fi for Transactions: Conduct transactions only over secure, private internet connections to prevent hacking attempts.

- Keep Transaction Records: Maintain detailed records of all transactions for tax and compliance purposes.

- Test with a Small Amount First: Before transferring a large sum, conduct a test transaction with a smaller amount to ensure everything works as expected.

- Stay Informed About Scams: Keep yourself updated on common crypto scams and phishing attempts.

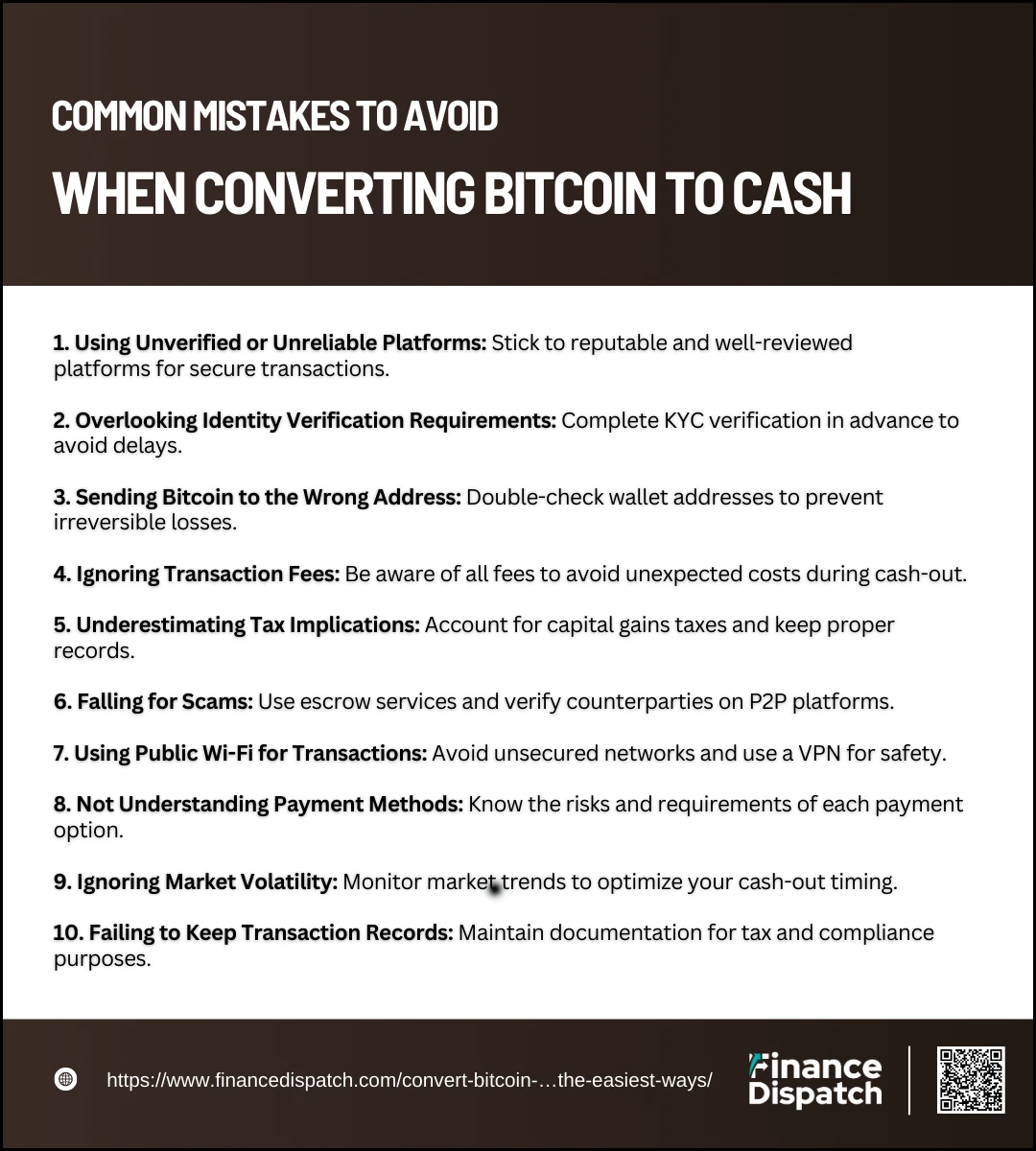

Common Mistakes to Avoid When Converting Bitcoin to Cash

Converting Bitcoin into cash might seem straightforward, but small mistakes can have significant consequences. Whether you’re using a centralized exchange, peer-to-peer (P2P) platform, Bitcoin ATM, or crypto debit card, overlooking key details can result in financial losses, delays, or even compromised security. Many beginners and even experienced users fall into common traps that could easily be avoided with proper knowledge and caution. Below, we’ll explore the most frequent mistakes made during Bitcoin-to-cash transactions and provide insights on how you can steer clear of them.

1. Using Unverified or Unreliable Platforms

Choosing the wrong platform is one of the biggest mistakes people make. Not all exchanges or P2P platforms are created equal, and some may lack proper security measures or have a history of scams. Always do thorough research, read reviews, and stick to reputable platforms with proven track records.

2. Overlooking Identity Verification Requirements

Most centralized exchanges require you to complete Know Your Customer (KYC) verification before allowing you to cash out. Failing to prepare the necessary identification documents can lead to delays or even account restrictions. Completing this step in advance ensures a smoother cash-out process.

3. Sending Bitcoin to the Wrong Address

Bitcoin transactions are irreversible, and sending your funds to an incorrect or fraudulent wallet address means you’ll lose your money permanently. Always double-check the recipient’s wallet address and consider doing a small test transaction before transferring large amounts.

4. Ignoring Transaction Fees

Every method of converting Bitcoin to cash comes with fees, including trading fees, withdrawal charges, network fees, and ATM operator fees. Ignoring these costs can result in receiving far less cash than expected. Make sure you understand all associated fees before finalizing your transaction.

5. Underestimating Tax Implications

Cashing out Bitcoin often triggers capital gains taxes, depending on your country’s laws. Failing to account for tax obligations can result in hefty fines or legal complications. Keep records of your transactions and consult a tax professional if necessary.

6. Falling for Scams

Scams remains a major risk in cryptocurrency transactions, especially on P2P platforms. Fraudsters often pose as legitimate buyers or sellers and trick users into releasing funds without fulfilling their end of the deal. Always verify the reputation and feedback of counterparties and use escrow services whenever possible.

7. Using Public Wi-Fi for Transactions

Conducting transactions over unsecured public Wi-Fi networks exposes your data to potential hacking attempts. Sensitive information, such as wallet credentials, can be intercepted. Always use a secure, private internet connection and consider using a VPN for added security.

8. Not Understanding Payment Methods

Different platforms offer various payment methods, including bank transfers, PayPal, and direct cash transactions. Each option comes with its own risks and requirements. For example, PayPal transactions might be reversible, leaving you vulnerable to fraud. Make sure you fully understand the payment method you choose.

9. Ignoring Market Volatility

Bitcoin is a highly volatile asset, and its price can change significantly within minutes. Selling Bitcoin during a price dip could mean missing out on higher profits. Keep an eye on market trends and consider timing your cash-out strategically.

10. Failing to Keep Transaction Records

Proper documentation is essential for tracking your transactions, especially for tax reporting and compliance purposes. Without transaction records, you may face challenges in proving the source of funds or calculating your tax obligations. Always save receipts, wallet addresses, and payment confirmations.

Conclusion

Converting Bitcoin to cash doesn’t have to be a complicated or risky process if approached with the right knowledge and precautions. With multiple methods available—ranging from centralized exchanges and peer-to-peer platforms to Bitcoin ATMs and crypto debit cards—you have the flexibility to choose an option that best aligns with your needs. However, prioritizing security, understanding transaction fees, and being aware of tax implications are essential to avoid costly mistakes. By selecting reputable platforms, double-checking wallet addresses, and keeping detailed records, you can ensure a smooth and secure Bitcoin-to-cash conversion experience. Whether you’re cashing out for everyday expenses, investment diversification, or locking in profits, a well-informed approach will always yield the best results.