Decentralized Finance, commonly known as DeFi, is an innovative financial ecosystem that operates on blockchain technology, enabling direct, peer-to-peer transactions without relying on traditional intermediaries like banks or brokers. Unlike the centralized systems that dominate conventional finance, DeFi leverages smart contracts—self-executing agreements coded on blockchain networks—to provide a wide range of financial services, including lending, borrowing, trading, and investing. With its decentralized nature, DeFi empowers users to retain full control of their assets, offering a transparent, open, and permissionless platform accessible to anyone with an internet connection. As a growing alternative to traditional financial systems, DeFi represents a bold step toward democratizing global finance and reducing the dependency on centralized institutions.

What Is the Technology Behind DeFi?

The technology powering Decentralized Finance (DeFi) is built on blockchain, the same foundation that supports cryptocurrencies like Bitcoin and Ethereum. By leveraging blockchain’s decentralized and transparent nature, DeFi eliminates the need for intermediaries, enabling secure and efficient financial transactions. At the heart of DeFi are smart contracts, decentralized applications (dApps), and other innovative tools that collectively form a trustless financial ecosystem.

1. Blockchain Networks

Blockchain serves as the foundational layer for all DeFi activities. It is a decentralized and immutable ledger that securely records every transaction across a distributed network of computers. Ethereum has become the most popular blockchain for DeFi because of its ability to support smart contracts and decentralized applications (dApps). Other blockchains like Binance Smart Chain, Solana, and Avalanche are gaining traction due to their faster transaction speeds and lower fees. These blockchains ensure transparency, security, and accessibility, making them essential for DeFi’s operation.

1. Smart Contracts

Smart contracts are the heart of DeFi operations. These self-executing programs are coded to automatically enforce agreements between parties when specific conditions are met. For instance, a lending smart contract can automatically disburse funds once the borrower provides sufficient collateral. Smart contracts reduce the need for intermediaries, enhance efficiency, and minimize the potential for disputes or fraud. Their tamper-proof nature ensures that all transactions proceed as programmed without manual intervention.

2. Decentralized Applications (dApps)

dApps are user-facing software that allows individuals to interact with DeFi services without needing to understand the complexities of blockchain technology. They provide accessible interfaces for activities like lending, borrowing, staking, and trading. Examples include Uniswap for decentralized trading and Aave for lending and borrowing. By automating backend processes and presenting user-friendly designs, dApps enable broader adoption of DeFi.

3. Cryptographic Security

DeFi platforms rely on advanced cryptographic techniques to secure user data and assets. Each user holds a private key, which acts as their unique access code to their funds. This cryptography ensures that only the rightful owner can authorize transactions. Unlike traditional systems, where centralized servers are vulnerable to hacks, DeFi’s decentralized nature and cryptographic encryption significantly reduce the risks of data breaches or unauthorized access.

4. Tokenization

Tokenization is the process of representing real-world or digital assets as tokens on a blockchain. These tokens can include cryptocurrencies, stablecoins, or even tokenized versions of real estate, art, and stocks. By tokenizing assets, DeFi enables seamless trading, fractional ownership, and global liquidity. Tokens also facilitate rewards, governance, and staking mechanisms within DeFi platforms.

5. Decentralized Exchanges (DEXs)

DEXs allow users to trade cryptocurrencies directly with one another without a central authority. Using smart contracts, DEXs like Uniswap and PancakeSwap match buyers and sellers and automate transactions. They employ mechanisms such as automated market makers (AMMs) or order books to maintain liquidity and ensure seamless trades. Unlike centralized exchanges, DEXs give users full control over their funds and promote privacy and security.

6. Oracles

Oracles bridge the gap between blockchain and external real-world data. They feed essential information—such as live asset prices, weather conditions, or sports outcomes—into blockchain networks. For example, an oracle can provide price data for a decentralized lending platform, enabling accurate interest calculations. Without oracles, blockchains would lack the ability to interact with off-chain data, limiting the scope of DeFi applications.

7. Interoperability Protocols

Interoperability is the ability of different blockchain networks to communicate and exchange data seamlessly. Protocols like Polkadot, Cosmos, and Chainlink enable DeFi applications to function across multiple blockchains, expanding their utility and reach. For instance, a user can borrow funds on one blockchain and trade them on another, creating a more interconnected and efficient ecosystem.

8. Layer 2 Solutions

Layer 2 solutions are technologies built on top of blockchains to address scalability issues. Examples include rollups and sidechains that process transactions off the main chain, significantly reducing congestion and transaction fees. For DeFi users, these solutions ensure faster processing times and lower costs, making platforms more efficient and user-friendly, even during periods of high demand.

9. Stablecoins

Stablecoins are cryptocurrencies pegged to stable assets, such as the U.S. dollar or gold, to reduce volatility. They play a pivotal role in DeFi by providing a stable medium of exchange, especially for lending, borrowing, and trading activities. Popular examples like USDT (Tether) and DAI enable users to interact with DeFi protocols without being exposed to the wild price swings of traditional cryptocurrencies.

Common Decentralized Finance Use Cases

Decentralized Finance (DeFi) offers a wide range of applications that go beyond traditional financial services, leveraging blockchain technology to provide innovative solutions. From lending and borrowing to asset trading and yield generation, DeFi empowers users with tools to take full control of their financial activities. Here are some of the most common and impactful use cases of DeFi.

1. Lending and Borrowing

DeFi platforms like Aave, Compound, and MakerDAO facilitate peer-to-peer lending and borrowing without intermediaries. Lenders can deposit their crypto assets into liquidity pools and earn interest, while borrowers can access funds by providing collateral. Unlike traditional systems, there are no credit checks, making lending accessible to anyone with sufficient collateral. Smart contracts automate these processes, ensuring transparency and security.

2. Decentralized Exchanges (DEXs)

Decentralized exchanges, such as Uniswap, PancakeSwap, and SushiSwap, enable users to trade cryptocurrencies directly without the need for a central authority or intermediary. These platforms use smart contracts to match buyers and sellers, ensuring transparency and security. Users maintain full control over their funds during transactions, avoiding the risks associated with centralized exchanges, such as hacking or loss of assets.

3. Stablecoins

Stablecoins like DAI, USDC, and USDT are pegged to stable assets such as fiat currencies or commodities to reduce the price volatility associated with traditional cryptocurrencies. They are widely used in DeFi for payments, lending, and trading. Stablecoins provide a stable store of value and are ideal for activities like borrowing or earning interest.

4. Yield Farming and Liquidity Mining

Yield farming involves providing liquidity to DeFi platforms in exchange for rewards, often paid in native tokens. Liquidity mining is a subset where users earn tokens for supplying liquidity to specific pools. These strategies maximize returns by enabling users to participate in multiple platforms that offer competitive yields. Platforms like Yearn Finance and Curve Finance are popular for these activities.

5. Staking

Staking allows users to lock up their cryptocurrencies in a network to support operations such as transaction validation and earn rewards. Proof-of-stake (PoS) networks like Ethereum 2.0 rely heavily on staking, and DeFi platforms like Lido offer flexible staking options. Staking provides a steady income stream for participants while contributing to the network’s security.

6. Asset Management

DeFi simplifies asset management by offering tools for automated portfolio optimization. Platforms like Yearn Finance aggregate and allocate user funds across multiple DeFi protocols to ensure maximum returns. These automated systems reduce the complexity of managing assets, making it easier for users to grow their investments.

7. Decentralized Insurance

Platforms like Nexus Mutual and Insurance offer decentralized insurance products that protect users from risks such as smart contract failures, exchange hacks, or loss of funds. DeFi insurance pools are funded by community members who earn rewards for providing coverage. This ensures transparency and allows users to safeguard their investments within the ecosystem.

8. Payment Solutions

DeFi platforms enable fast, low-cost, and borderless payment solutions. Projects like Stellar and the Lightning Network facilitate global transactions by eliminating intermediaries, reducing fees, and speeding up processing times. This makes DeFi an ideal solution for remittances, cross-border payments, and merchant transactions.

9. Prediction Markets

Decentralized prediction markets like Augur and Polymarket allow users to bet on the outcome of various events, including elections, sports, or market trends. These platforms are powered by smart contracts, ensuring fair payouts based on real-world outcomes provided by oracles. They offer a transparent and secure alternative to traditional betting markets.

10. NFTs and Gaming

Non-fungible tokens (NFTs) have revolutionized digital ownership, enabling the creation, trade, and use of unique digital assets. Platforms like Axie Infinity and OpenSea allow users to engage in gaming, art, and collectibles through NFTs. DeFi integrates with these ecosystems, providing mechanisms for trading and collateralizing NFTs.

11. Tokenized Real-World Assets

DeFi enables the representation of real-world assets, such as real estate, art, or commodities, as digital tokens on a blockchain. Platforms like RealT tokenize properties, allowing fractional ownership and trading. These tokenized assets bring liquidity to traditionally illiquid markets and expand investment opportunities.

DeFi vs. Centralized Finance

Decentralized Finance (DeFi) and centralized finance (CeFi) represent two fundamentally different approaches to financial systems. CeFi relies on intermediaries like banks, brokers, and centralized exchanges to facilitate transactions, enforce trust, and provide services. In contrast, DeFi uses blockchain technology, smart contracts, and decentralized applications to eliminate intermediaries, giving users full control over their funds and promoting transparency. While both systems offer financial services, their methods and principles vary significantly.

| Aspect | Decentralized Finance (DeFi) | Centralized Finance (CeFi) |

| Control | Users have full control over their assets through private wallets and smart contracts. | Assets are held and managed by centralized entities like banks or exchanges. |

| Intermediaries | Eliminates intermediaries by using blockchain technology and smart contracts. | Relies on intermediaries such as banks, brokers, and custodial platforms to facilitate transactions. |

| Accessibility | Open to anyone with an internet connection, with no geographic or eligibility restrictions. | Access may be restricted by geographic location, regulations, or institutional policies. |

| Transparency | Transactions and smart contracts are publicly visible on the blockchain. | Transactions and operations are typically opaque and controlled by centralized entities. |

| Security | Secured through decentralized networks and cryptography but vulnerable to coding bugs and exploits. | Relies on centralized entities’ security measures but is prone to large-scale breaches. |

| Fees | Generally lower, as intermediaries are removed, though gas fees may apply. | Often higher due to intermediaries, transaction fees, and service charges. |

| Transaction Speed | Transactions are processed instantly or within minutes depending on blockchain congestion. | Transaction times vary and can take days, especially for cross-border payments. |

| Censorship Resistance | Highly resistant to censorship; transactions cannot be easily blocked or reversed. | Transactions can be censored, reversed, or frozen by authorities or centralized entities. |

| Innovation | Rapid innovation through open-source protocols and global developer collaboration. | Innovation is slower due to regulatory constraints and centralized decision-making. |

| Regulation | Operates in a largely unregulated or self-regulated environment. | Strictly regulated by governments and financial authorities. |

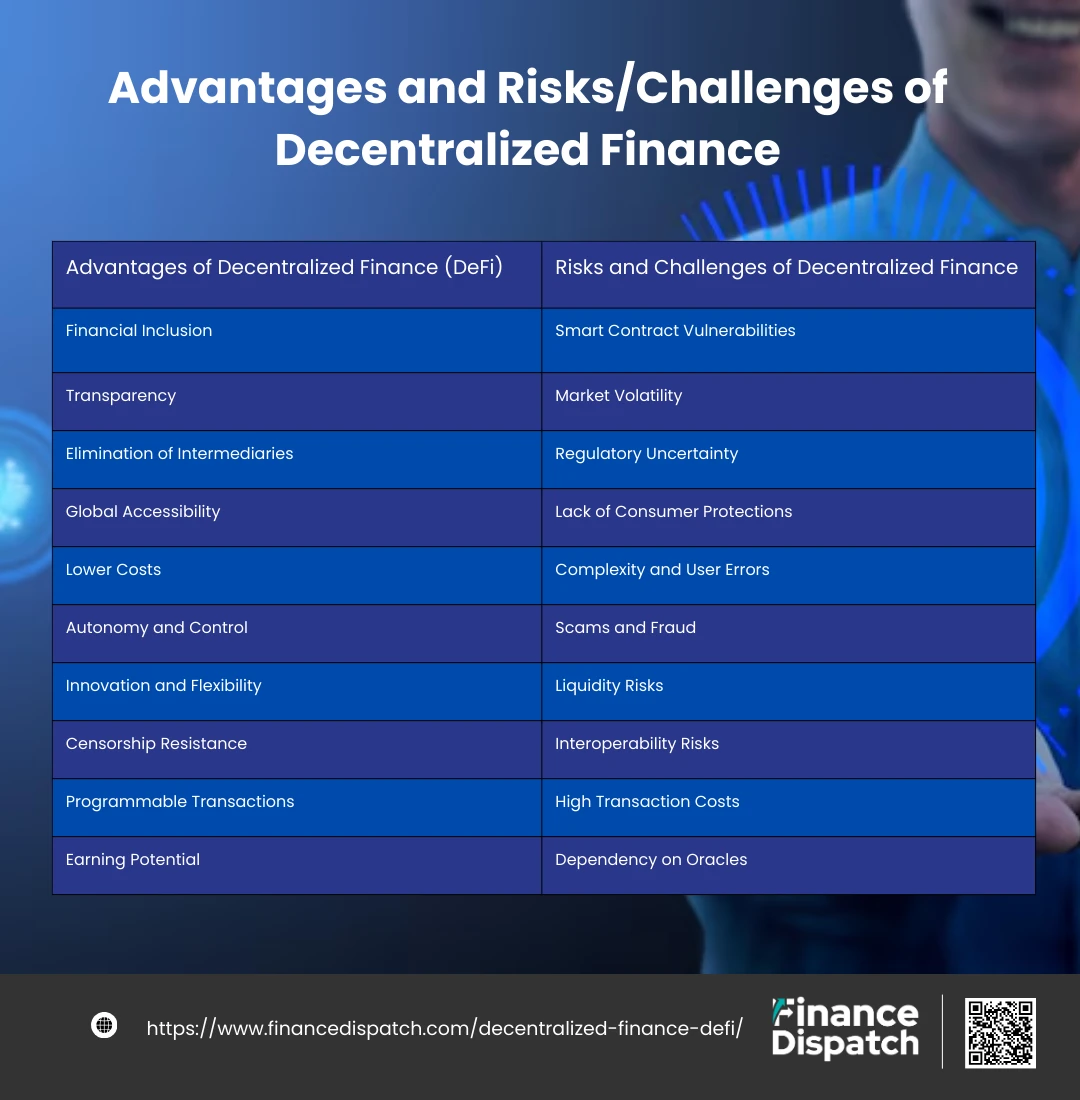

Advantages of Decentralized Finance

Decentralized Finance (DeFi) is revolutionizing the way people access and manage financial services by leveraging blockchain technology to create an open, transparent, and efficient ecosystem. Unlike traditional finance, DeFi eliminates intermediaries, offering users more control over their assets and enabling greater financial inclusion. Its decentralized nature ensures accessibility for all, reduced costs, and innovative ways to grow and manage wealth.

1. Financial Inclusion

DeFi breaks down barriers to financial services, offering access to anyone with an internet connection, regardless of their location, income level, or credit history. This is particularly impactful in regions with limited banking infrastructure, allowing the unbanked and underbanked population to participate in the global economy. By using a digital wallet, users can lend, borrow, save, or trade assets without needing a traditional bank account or approval from a central authority.

2. Transparency

All transactions on DeFi platforms are recorded on public blockchains, where they are visible to anyone. This transparency ensures accountability and reduces the likelihood of fraud. Smart contracts, the backbone of DeFi, are also open-source, allowing anyone to audit the code and verify its functionality. This builds trust among users and ensures that the platform operates as intended.

3. Elimination of Intermediaries

DeFi removes the need for third parties such as banks, brokers, and payment processors by enabling peer-to-peer transactions. This not only reduces costs associated with intermediaries but also empowers users to interact directly with one another. The absence of middlemen also reduces delays in transaction processing, making the system faster and more efficient.

4. Global Accessibility

DeFi platforms operate around the clock, unlike traditional banks that are restricted by business hours and regional limitations. Users can access financial services at any time, from anywhere in the world, as long as they have an internet connection. This universal accessibility makes DeFi a borderless financial system.

5. Lower Costs

Traditional financial services often involve high fees for transactions, account maintenance, and international transfers. DeFi minimizes these costs by eliminating intermediaries and automating processes with smart contracts. While network fees (e.g., gas fees on Ethereum) may still apply, they are typically lower than fees charged by banks and financial institutions.

6. Autonomy and Control

DeFi users have full control over their assets, as funds are stored in personal digital wallets rather than in bank accounts managed by third parties. This autonomy ensures that users are not subjected to account freezes, arbitrary restrictions, or unauthorized access. Users also have the freedom to manage and transfer their funds as they see fit.

7. Innovation and Flexibility

The open-source nature of DeFi platforms encourages developers worldwide to create innovative financial products and services. This has resulted in a diverse ecosystem offering unique opportunities like yield farming, staking, flash loans, and liquidity mining. These products are continuously evolving, providing users with flexible and dynamic financial solutions.

8. Censorship Resistance

DeFi operates on decentralized networks that are resistant to censorship. Unlike traditional financial systems where governments or institutions can freeze accounts or block transactions, DeFi ensures that users retain control over their funds and can transact freely without interference.

9. Programmable Transactions

DeFi utilizes smart contracts to automate financial processes. These contracts execute transactions automatically when predefined conditions are met, eliminating the need for manual intervention. For example, a smart contract can disburse a loan only after the borrower provides sufficient collateral. This automation reduces errors and ensures that agreements are honored precisely as written.

10. Earning Potential

DeFi offers multiple ways to earn passive income, such as staking tokens, providing liquidity to decentralized exchanges, or participating in yield farming. These activities often yield higher returns compared to traditional savings accounts or investment products. Additionally, DeFi allows users to diversify their earning strategies, enabling them to maximize their financial growth.

Risks and Challenges of Decentralized Finance

While Decentralized Finance (DeFi) offers numerous advantages, it also comes with inherent risks and challenges that users must understand. The relatively new and rapidly evolving nature of DeFi makes it susceptible to technical vulnerabilities, regulatory uncertainties, and market instability. Engaging in DeFi requires a thorough understanding of these risks to make informed decisions and protect one’s investments.

1. Smart Contract Vulnerabilities

Smart contracts are integral to DeFi, automating transactions and removing intermediaries. However, they are only as secure as their code. Bugs, poorly written logic, or overlooked scenarios in the contract can be exploited by hackers to drain funds from a platform. Even audited contracts are not immune, as new vulnerabilities or unforeseen exploits can arise. Users depend on developers and auditors to ensure code integrity, but no system is entirely foolproof.

2. Market Volatility

The cryptocurrencies powering DeFi are known for their extreme price swings. This volatility poses risks to borrowers and lenders alike. For instance, collateralized loans in DeFi require users to maintain a specific collateral-to-loan ratio. If the value of the collateral drops sharply, the position can be liquidated, resulting in significant losses for the borrower. Similarly, yield farmers and liquidity providers are exposed to the risk of impermanent loss due to fluctuating token prices.

3. Regulatory Uncertainty

DeFi operates in a gray area of regulation. Governments and financial regulators are still determining how to address decentralized systems. Future regulations could impose restrictions, require compliance measures, or even ban certain activities, creating uncertainty for platforms and users. Additionally, cross-border transactions complicate enforcement and compliance, as different jurisdictions may have conflicting regulations.

4. Lack of Consumer Protections

Unlike traditional financial institutions, DeFi lacks safety nets such as government-backed insurance or regulatory oversight. If funds are lost due to hacking, smart contract failures, or platform insolvency, users have little to no recourse for recovery. This absence of safeguards increases the risks for participants who may lose their entire investment in the event of a mishap.

5. Complexity and User Errors

DeFi platforms often require users to understand blockchain technology, digital wallets, and transaction fees. For newcomers, the technical complexity can lead to costly mistakes, such as sending assets to the wrong address, interacting with fraudulent platforms, or mismanaging private keys. These errors are typically irreversible, leaving users without the ability to recover lost funds.

6. Scams and Fraud

The open and decentralized nature of DeFi attracts bad actors who create fraudulent projects or phishing schemes to exploit unsuspecting users. Fake platforms can impersonate legitimate ones, while some projects may implement “rug pulls,” where developers abandon a project after draining its liquidity. Users must thoroughly research platforms and rely on trusted sources before committing funds.

7. Liquidity Risks

Smaller or less popular DeFi platforms may suffer from low liquidity, making it challenging for users to trade assets or withdraw funds without significant price slippage. Insufficient liquidity can also make the platform more susceptible to manipulation, as large trades can disproportionately affect market prices.

8. Interoperability Risks

Many DeFi platforms rely on interoperability to interact with other blockchains or protocols. While this expands functionality, it also introduces vulnerabilities. If one component fails, such as a cross-chain bridge or protocol integration, it can cause widespread disruptions or losses across connected platforms.

9. High Transaction Costs

During times of network congestion, transaction fees—especially on Ethereum—can rise dramatically, making DeFi interactions costly. This can deter small investors or make certain DeFi activities, such as yield farming or frequent trades, unprofitable. High fees can also slow the adoption of DeFi among users who cannot afford these costs.

10. Dependency on Oracles

Oracles are external data providers that feed information, like price data, into blockchain systems. If an oracle provides incorrect data—due to malfunction, manipulation, or latency—it can cause smart contracts to execute incorrectly. For example, incorrect price feeds might trigger unnecessary liquidations or cause financial losses during automated trades.

The Future of Decentralized Finance

The future of Decentralized Finance (DeFi) holds immense potential to reshape the global financial landscape by making services more accessible, transparent, and efficient. As blockchain technology advances, DeFi is expected to address current challenges such as scalability, high transaction costs, and security vulnerabilities. Innovations like Layer 2 solutions, cross-chain interoperability, and enhanced smart contract functionality will likely drive mainstream adoption. Additionally, the integration of DeFi with traditional finance through hybrid models could create a more inclusive financial ecosystem. However, the evolution of DeFi will also depend on navigating regulatory frameworks, improving user experiences, and fostering trust among participants. As the industry matures, DeFi has the potential to democratize finance, empowering individuals and businesses worldwide while challenging the dominance of traditional financial institutions.

Conclusion

Decentralized Finance (DeFi) is revolutionizing the way people interact with financial systems by offering open, transparent, and inclusive solutions powered by blockchain technology. While it presents unique advantages like financial autonomy, lower costs, and global accessibility, it also carries risks such as market volatility, regulatory uncertainties, and smart contract vulnerabilities. As DeFi continues to evolve, it holds the promise of democratizing finance, bridging gaps for the unbanked, and fostering innovation across industries. By understanding its potential and challenges, users can make informed decisions and contribute to the growth of this transformative ecosystem. The future of DeFi lies in collaboration, innovation, and responsible adoption, paving the way for a more equitable and decentralized financial world.

FAQs

1. Can DeFi platforms operate without internet access?

No, DeFi platforms rely entirely on internet connectivity to function. Blockchain networks and smart contracts require constant access to the internet for transactions, validations, and interactions with decentralized applications (dApps). Without an internet connection, users cannot interact with DeFi platforms or access their digital wallets.

2. How does DeFi handle disputes or errors in transactions?

DeFi operates on immutable smart contracts, meaning once a transaction is executed, it cannot be reversed or altered. This lack of dispute resolution mechanisms makes it essential for users to double-check all transaction details before proceeding. Some DeFi platforms are exploring ways to implement decentralized arbitration systems, but these are still in their early stages

3. Is it possible to participate in DeFi without directly using cryptocurrencies?

While most DeFi platforms require cryptocurrencies for transactions, some services allow users to access DeFi through tokenized fiat currencies or stablecoins like USDC or DAI. These assets reduce exposure to cryptocurrency volatility, making DeFi more accessible for users who prefer stability.

4. What is the environmental impact of DeFi?

The environmental impact of DeFi depends on the blockchain network it operates on. For example, platforms built on proof-of-work (PoW) blockchains like Ethereum (prior to its move to proof-of-stake) consume significant energy, raising sustainability concerns. However, newer DeFi projects are leveraging energy-efficient blockchains like Solana or proof-of-stake (PoS) systems to minimize environmental impact.

5. How are decentralized governance decisions made in DeFi platforms?

Decentralized Finance platforms often use governance tokens to empower users in decision-making processes. Holders of these tokens can vote on proposals for updates, feature additions, or protocol changes. This decentralized governance model allows the community to shape the platform’s future direction, though active participation and consensus are essential for effective decision-making.