Have you ever found yourself needing a bit of extra money to cover an unexpected expense? A bank overdraft can provide a quick financial cushion when your bank balance falls short. However, while it may seem like a helpful safety net, it’s essential to understand how overdrafts work and the potential impact they can have on your financial health. From fees and interest rates to the risk of over-reliance, learning about overdrafts can help you make informed decisions and manage your finances responsibly.

What is a Bank Overdraft?

A bank overdraft is a financial arrangement that allows you to withdraw more money from your account than you currently have available, up to a pre-approved limit. Essentially, it acts as a short-term loan provided by your bank to help you cover unexpected expenses or manage cash flow gaps. While overdrafts can be a convenient way to access extra funds, they often come with interest charges and fees that vary depending on your bank and the type of overdraft. Understanding how this facility works is crucial to using it effectively without compromising your financial health.

How Bank Overdrafts Impact Financial Health

Bank overdrafts can be a double-edged sword when it comes to your financial health. On one hand, they provide a quick safety net for unexpected expenses, but on the other, they can lead to significant challenges if not managed responsibly. The convenience of overdrafts often masks the hidden costs and risks that come with them. Below, we explore the various ways overdrafts can influence your financial stability:

1. Accruing High Interest and Fees

Overdrafts often come with steep interest rates and additional fees for usage. These charges can quickly snowball, especially if you only make minimum repayments or delay clearing the overdraft balance.

2. Risk of Over-Reliance

While overdrafts can be helpful in emergencies, consistently relying on them as a financial buffer can lead to unhealthy financial habits. Over-reliance may cause you to live beyond your means, pushing you further into debt.

3. Cycle of Debt

Failing to repay your overdraft promptly can trap you in a debt cycle. High-interest rates and recurring fees make it harder to escape, leaving less room in your budget for essential expenses or savings.

4. Impact on Credit Score

Unauthorized overdrafts or exceeding your limit can reflect poorly on your credit report. This can lower your credit score, making it difficult to secure loans, credit cards, or even rental agreements in the future.

5. Stress on Financial Planning

Managing an overdraft balance alongside regular expenses can disrupt your financial plans. The need to constantly allocate funds toward repaying overdrafts can hinder your ability to save for goals like a vacation, home, or retirement.

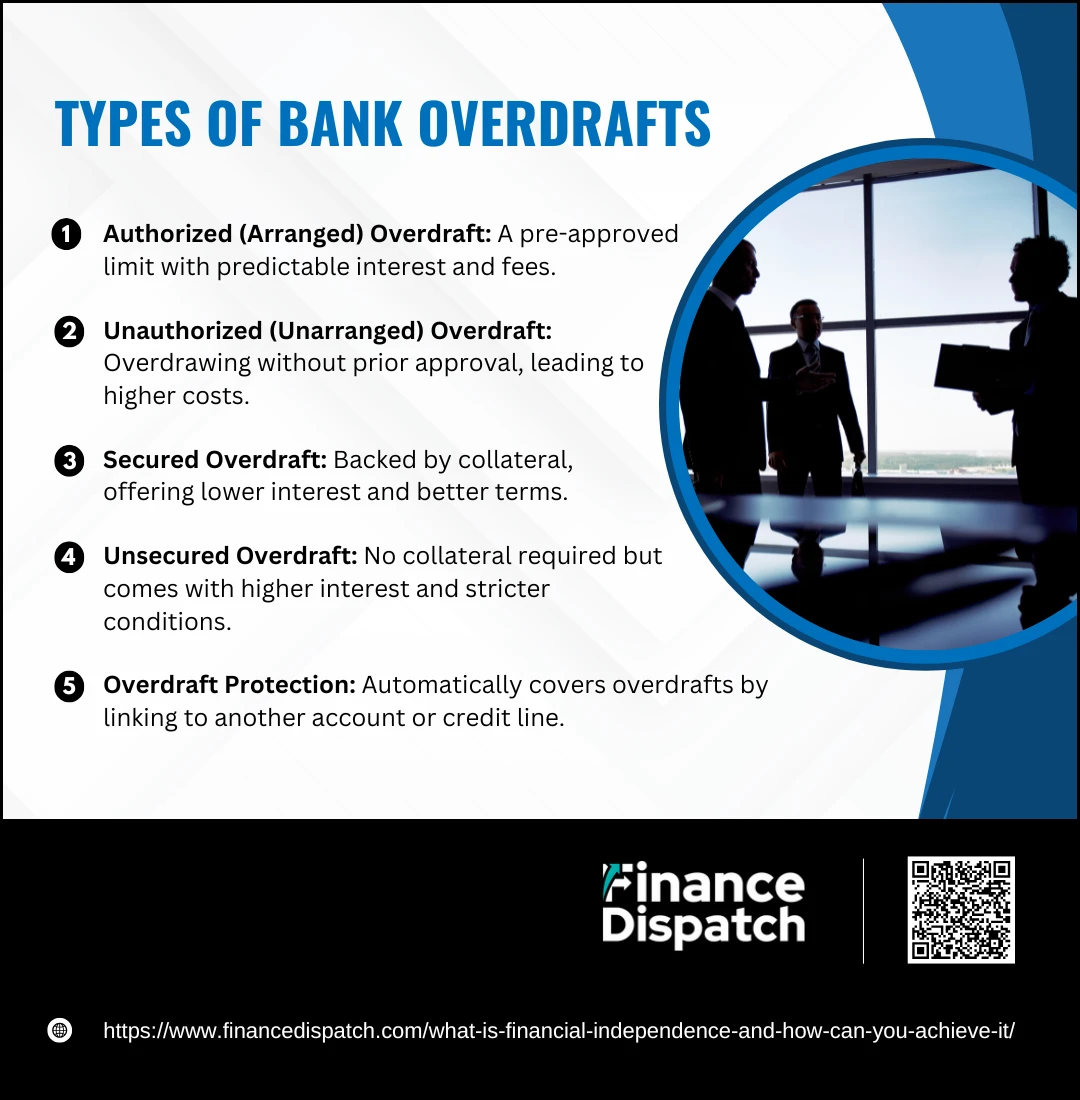

Types of Bank Overdrafts

A bank overdraft provides financial flexibility by allowing you to withdraw more than your available balance, but not all overdrafts are created equal. Different types cater to various needs, offering unique features, interest rates, and repayment terms. By understanding these types, you can make better financial decisions and avoid unnecessary costs. Here’s a detailed look at the types of bank overdrafts:

1. Authorized (Arranged) Overdraft

An authorized overdraft is a pre-agreed facility between you and your bank, allowing you to overdraw your account up to a specific limit. It often comes with predictable interest rates and lower fees compared to unauthorized overdrafts. This type is ideal for planned expenses or short-term financial gaps where you need assurance of borrowing limits.

2. Unauthorized (Unarranged) Overdraft

This occurs when you spend more than your account balance without prior agreement with the bank. Unauthorized overdrafts typically come with higher interest rates, penalty fees, and potential damage to your credit rating. They are best avoided as they can quickly become costly.

3. Secured Overdraft

A secured overdraft requires collateral, such as a fixed deposit or another valuable asset, to back the facility. Because it reduces the bank’s risk, secured overdrafts often have better interest rates and terms. They are a suitable option for individuals or businesses with assets to pledge who want more favorable borrowing conditions.

4. Unsecured Overdraft

Unlike secured overdrafts, this type doesn’t require collateral. However, unsecured overdrafts come with higher interest rates and stricter repayment terms, reflecting the increased risk for the bank. They are accessible for those without assets but should be used cautiously due to the higher cost.

5. Overdraft Protection

This service links your checking account to another account, such as a savings account or credit card, to automatically cover any overdrafts. While it may involve a small transfer fee, overdraft protection can save you from the steep penalties and interest charges associated with unauthorized overdrafts.

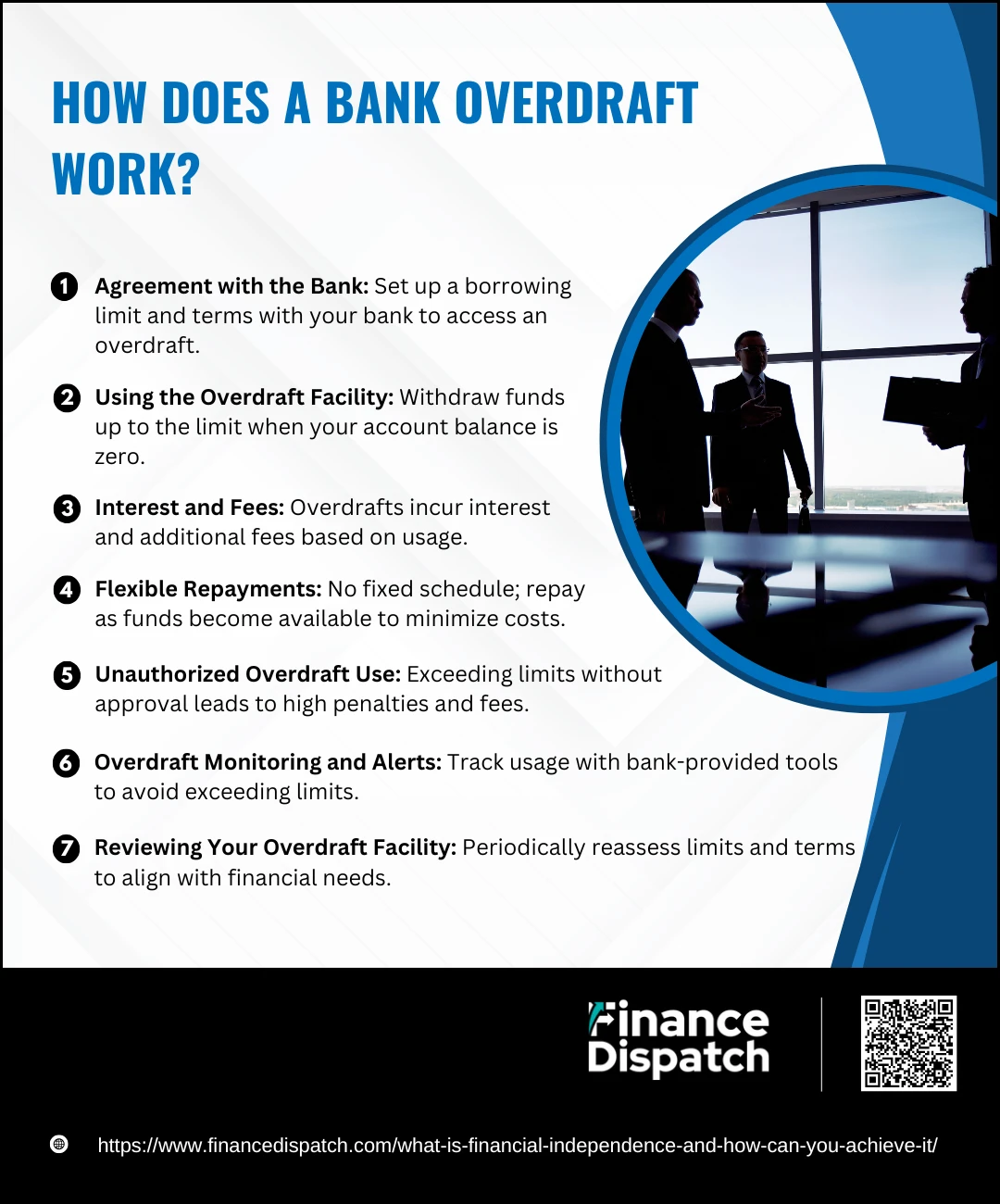

How Does a Bank Overdraft Work?

A bank overdraft provides a convenient way to access funds when your account balance is insufficient to cover a transaction. Essentially, it acts as a short-term loan from your bank, helping you manage unexpected expenses or temporary cash flow shortages. Whether you have an authorized arrangement or rely on an unarranged overdraft, understanding how the process works is crucial to avoid financial pitfalls. Here’s a detailed breakdown of how a bank overdraft functions:

1. Agreement with the Bank

To access an overdraft, you need to establish an arrangement with your bank. For authorized overdrafts, this includes setting a borrowing limit based on your financial profile, agreeing on interest rates, and understanding any associated fees. This agreement serves as a safety net for emergencies or planned expenditures.

2. Using the Overdraft Facility

Once your account balance reaches zero, the overdraft facility is triggered, allowing you to withdraw funds up to the agreed limit. For example, if your account balance is $0 and your authorized overdraft limit is $500, you can still make purchases or withdrawals within that limit.

3. Interest and Fees

Overdrafts come with costs, including interest on the borrowed amount and possible fees such as daily usage charges or transaction-based fees. Interest rates vary depending on the type of overdraft and your bank’s policies, so understanding the terms upfront is critical.

4. Flexible Repayments

Unlike traditional loans, overdrafts usually don’t have fixed repayment schedules. Instead, you’re expected to deposit funds into your account to cover the overdraft balance and accumulated costs. The faster you repay, the less you’ll pay in interest.

5. Unauthorized Overdraft Use

If you withdraw more than your overdraft limit or don’t have a prior agreement with your bank, this results in an unauthorized overdraft. These are subject to higher fees, penalties, and potential declined transactions, which can also impact your credit score.

6. Overdraft Monitoring and Alerts

Most banks offer tools to help you track your overdraft usage, such as mobile alerts, online banking dashboards, and account summaries. Keeping an eye on your account ensures you stay within your limit and repay on time.

7. Reviewing Your Overdraft Facility

Overdraft limits and terms aren’t static. It’s wise to periodically review your agreement with the bank to ensure the facility aligns with your financial needs. You might negotiate lower fees or higher limits if your circumstances change.

Benefits of a Bank Overdraft

A bank overdraft is a financial tool that provides a safety net when your account balance isn’t enough to cover expenses. Whether you need funds for an emergency or to manage cash flow, an overdraft offers flexibility and convenience. Unlike traditional loans, overdrafts are easy to access, making them a popular choice for individuals and businesses alike. Below are the detailed benefits of a bank overdraft:

1. Quick Access to Funds

Overdrafts allow you to withdraw money immediately when your account balance is insufficient. This quick access is especially helpful in urgent situations, such as medical emergencies or unexpected repairs.

2. Flexibility

With no fixed repayment schedules, overdrafts provide the flexibility to repay borrowed funds when it suits your financial situation. This can ease the pressure of meeting strict loan repayment deadlines.

3. Cost-Effective for Short-Term Needs

Compared to high-interest loans like payday loans, overdrafts can be a more affordable option for short-term borrowing. Interest and fees are usually charged only on the amount used, making it a cost-efficient choice for brief financial gaps.

4. Seamless Convenience

Overdrafts are directly linked to your checking account, allowing you to use them without additional applications or approvals. This integration ensures uninterrupted transactions, even when your balance falls short.

5. No Need for Collateral

Most overdraft facilities are unsecured, meaning you don’t have to pledge any assets to access funds. This makes them a hassle-free borrowing option for individuals without significant assets.

6. Avoiding Financial Penalties

An overdraft helps you avoid the penalties associated with missed payments, bounced checks, or failed transactions. By covering your financial obligations on time, you can maintain a good relationship with creditors and service providers.

7. Maintaining Credit Score

By preventing missed payments and defaults, overdrafts indirectly contribute to preserving your credit score. Timely repayments of overdraft balances further strengthen your financial credibility.

8. Business Cash Flow Management

For small businesses, overdrafts are an essential tool for managing cash flow irregularities. They ensure smooth operations by covering short-term expenses, such as payroll or supplier payments, during periods of low cash inflow.

9. Customizable Limits

Many banks offer personalized overdraft limits based on your financial profile and needs. This customization ensures you don’t over-borrow while still having sufficient coverage for emergencies.

Potential Drawbacks and Risks of Bank Overdraft

While bank overdrafts can be a convenient solution for managing short-term cash flow issues, they are not without risks. If not used wisely, overdrafts can quickly turn into a financial burden, leading to additional costs and long-term challenges. Understanding these potential drawbacks is essential to avoid common pitfalls and maintain financial stability. Below are the key risks and drawbacks of bank overdrafts:

1. High Interest Rates and Fees

Overdrafts often come with significantly higher interest rates compared to other forms of credit. Additionally, banks may charge daily or monthly fees, as well as penalties for exceeding your overdraft limit. These costs can accumulate rapidly, making overdrafts an expensive borrowing option.

2. Risk of Over-Reliance

The convenience of overdrafts can lead to over-reliance, where you repeatedly use the facility to cover expenses. This habit can create a cycle of dependency, making it harder to manage your finances or break free from debt.

3. Unauthorized Overdraft Penalties

If you spend more than your authorized limit or use an overdraft without prior arrangement, banks may impose heavy penalties. Unauthorized overdrafts often come with even higher interest rates and fees, which can strain your finances further.

4. Impact on Credit Score

Mismanaging your overdraft, such as failing to repay the balance or frequently exceeding your limit, can negatively affect your credit score. A lower credit score can impact your ability to access loans, credit cards, or mortgages in the future.

5. Unpredictable Costs

Since overdrafts don’t have a structured repayment plan, the total borrowing cost can be difficult to predict. If you don’t monitor your usage closely, you may face unexpected financial strain from accumulated interest and fees.

6. Stress on Financial Stability

Constantly needing to manage overdraft repayments on top of regular expenses can lead to financial instability. This can disrupt your ability to save, budget effectively, or plan for future goals.

7. Limited Long-Term Viability

Overdrafts are intended for short-term financial needs. Using them as a long-term credit solution can result in higher overall costs compared to alternatives like personal loans, which often offer lower interest rates and fixed repayment terms.

8. Reduced Financial Discipline

Easy access to overdraft funds may discourage you from adopting disciplined financial habits, such as budgeting or maintaining an emergency savings fund. This can lead to long-term financial difficulties.

9. Potential for Declined Transactions

If you exceed your overdraft limit or have an unauthorized overdraft, the bank may decline transactions, leading to inconvenience and potential embarrassment, especially in critical situations.

10. Business-Specific Risks

For small businesses, relying heavily on overdrafts to manage cash flow can hinder growth and make it harder to secure other financing options. Frequent overdraft use may also signal poor financial management to investors or creditors.

Comparing Overdrafts with Other Financial Products

When considering financial solutions for short-term needs, it’s important to evaluate how overdrafts compare to other options like credit cards, personal loans, and payday loans. Each product has unique features, costs, and suitability depending on your circumstances. Below is a comparison table that highlights the key differences to help you make an informed decision.

| Feature | Overdraft | Credit Card | Personal Loan | Payday Loan |

| Purpose | Short-term liquidity for emergencies or gaps | Everyday spending and short-term financing | Larger, planned expenses or consolidation | Immediate cash for emergencies |

| Access | Linked to checking account, automatic use | Requires card swipe or online transaction | Requires application and approval | Requires application, often instant |

| Repayment Terms | Flexible, no fixed schedule | Minimum monthly payments required | Fixed monthly installments | Lump sum repayment on next payday |

| Interest Rates | Typically high, charged on usage | Moderate, may offer interest-free periods | Lower, fixed rates | Extremely high |

| Fees | Usage, overdraft, and unauthorized fees | Late payment and cash advance fees | Origination or processing fees | High upfront fees |

| Credit Score Impact | Affects score if overused or mismanaged | Can build or hurt score depending on usage | Can build score if paid as agreed | Generally not reported to credit bureaus |

| Collateral Required | None | None | Often none | None |

| Flexibility | High, automatic use when needed | Medium, dependent on credit limit | Low, structured payments | None |

| Best For | Small, short-term emergencies | Everyday purchases or planned expenses | Larger, structured borrowing needs | Last resort for urgent cash |

Tips for Managing a Bank Overdraft

A bank overdraft can be a helpful financial tool when used wisely, but mismanagement can lead to costly fees and long-term debt. To make the most of your overdraft and maintain financial stability, it’s essential to adopt effective strategies. Here are some practical tips for managing a bank overdraft responsibly:

- Monitor Your Account Regularly

Keep track of your account balance to avoid accidentally dipping into your overdraft or exceeding the limit. - Set Up Low-Balance Alerts

Use your bank’s notification services to receive alerts when your balance approaches zero or enters overdraft territory. - Repay the Overdraft Quickly

Treat your overdraft like a short-term loan and aim to repay the balance as soon as possible to minimize interest and fees. - Negotiate Terms with Your Bank

If you anticipate prolonged overdraft usage, consider discussing your situation with your bank. They may offer lower interest rates or a structured repayment plan. - Avoid Unnecessary Spending

Prioritize essential expenses and cut back on discretionary spending while using your overdraft to reduce the amount borrowed. - Link to a Savings Account

Consider setting up overdraft protection by linking your checking account to a savings account. This can automatically cover overdrafts and reduce fees. - Create an Emergency Fund

Build an emergency fund to reduce reliance on overdrafts for unexpected expenses in the future. - Understand Your Overdraft Fees and Limits

Familiarize yourself with your bank’s overdraft policy, including interest rates, fees, and the maximum limit to avoid surprises. - Plan for Regular Deposits

Ensure your income or other deposits are sufficient and regular enough to repay the overdraft balance. - Seek Financial Advice if Needed

If you’re struggling to manage your overdraft, consult a financial advisor for guidance on debt management or alternative financial solutions.

Alternatives to Bank Overdrafts

While bank overdrafts offer a quick fix for short-term financial gaps, they can be costly due to high fees and interest rates. Exploring alternative options can help you manage your finances more efficiently without relying heavily on overdrafts. Here are some practical alternatives to consider:

- Personal Loans

For larger or planned expenses, personal loans often come with lower interest rates and structured repayment terms compared to overdrafts. - Credit Cards

Using a credit card with a reasonable limit and manageable interest rates can be a flexible alternative for short-term borrowing, especially when used responsibly. - Savings Account

Building an emergency savings fund allows you to handle unexpected expenses without borrowing or incurring interest. - Overdraft Protection

Link your checking account to a savings account or a line of credit to automatically cover overdrafts and reduce penalty fees. - Budgeting and Expense Tracking

A well-planned budget can help you anticipate financial gaps and allocate funds to avoid the need for an overdraft. - Payday Alternatives Loans (PALs)

Offered by credit unions, PALs are small-dollar loans with lower fees and better terms than payday loans or overdrafts. - Borrowing from Family or Friends

While not ideal for everyone, borrowing from trusted individuals can be a low-cost or interest-free solution for short-term needs. - Community Assistance Programs

Look into local programs or non-profits that offer financial aid for emergencies, reducing the need for borrowing. - Negotiate with Creditors

If you’re facing financial difficulties, consider negotiating with creditors for extended payment terms or reduced rates instead of using an overdraft. - Debt Consolidation

Consolidating higher-interest debts into a single, lower-interest loan can free up cash flow and reduce reliance on overdrafts.

Conclusion

A bank overdraft can be a useful financial tool when used thoughtfully, offering quick access to funds during emergencies or short-term financial gaps. However, it’s essential to understand its costs, risks, and limitations to avoid turning it into a financial burden. By exploring alternatives, managing overdrafts responsibly, and adopting sound financial practices like budgeting and saving, you can maintain your financial health and minimize reliance on costly borrowing. Making informed decisions ensures that a bank overdraft serves as a safety net rather than a recurring expense in your financial journey.