In an increasingly interconnected global economy, the term “tax haven” has become both a financial buzzword and a symbol of controversy. Originally conceived in the aftermath of World War II to help rebuild struggling economies, tax havens today are often associated with low or zero-tax jurisdictions that offer financial secrecy and legal incentives to attract foreign wealth. While these jurisdictions provide lawful opportunities for tax minimization, they are also criticized for facilitating tax avoidance, enabling inequality, and draining public resources. This article explores what tax havens are, how they operate, and why corporations and individuals are drawn to them—highlighting the benefits, risks, and the growing scrutiny surrounding their use.

What is a Tax Haven?

A tax haven is a country or jurisdiction that offers foreign individuals and businesses little to no tax liability, often combined with financial secrecy and minimal regulatory oversight. These regions are designed to attract capital from abroad by providing a favorable legal and tax environment, without requiring substantial local business activity or residency. While the use of tax havens is generally legal, the lack of transparency and disclosure requirements can make them attractive for those seeking to avoid taxes or hide assets. As a result, tax havens have become a popular strategy for multinational corporations and wealthy individuals aiming to minimize their tax burdens while maintaining a veil of financial privacy.

Key Characteristics of Tax Havens

Tax havens are not defined by a single feature but rather by a combination of legal, financial, and regulatory traits that make them appealing for those seeking to minimize tax liabilities. These jurisdictions are often marketed as secure, business-friendly environments with policies that favor foreign investors and high-net-worth individuals. Below are the core characteristics that typically define a tax haven:

1. Low or No Taxation: Tax havens either eliminate or significantly reduce taxes on income, capital gains, inheritance, or corporate profits.

2. Financial Secrecy: These jurisdictions offer strict privacy laws that shield the identity of account holders, companies, and beneficial owners.

3. Lack of Transparency: Regulatory systems in tax havens are often opaque, with limited public access to financial or corporate information.

4. No Requirement for Substantial Activity: Companies can be registered without conducting real business operations or maintaining a physical presence.

5. Minimal Reporting Obligations: Tax havens often do not require detailed financial disclosures, reducing oversight from foreign tax authorities.

6. Political and Economic Stability: These regions are typically stable and predictable, making them attractive for long-term wealth storage and investment.

7. Favorable Legal Systems: Legal frameworks in tax havens are often tailored to protect assets from litigation, creditors, or foreign claims.

Why Do Companies and Individuals Use Tax Havens?

Why Do Companies and Individuals Use Tax Havens?

Tax havens are attractive to corporations and high-net-worth individuals because they offer legal and financial structures that significantly reduce tax burdens and provide confidentiality. While often operating within legal boundaries, the ethical implications remain widely debated. Below are the key reasons—explained in depth—why these jurisdictions continue to be widely used:

1. Lower Tax Liability

The most obvious incentive is the opportunity to reduce or completely eliminate tax obligations. Tax havens impose little to no income tax, capital gains tax, or corporate tax. By shifting profits or registering entities in these jurisdictions, companies and individuals can lawfully minimize the taxes they would otherwise owe in higher-tax countries.

2. Financial Secrecy and Privacy

Many tax havens enforce strict banking and corporate confidentiality laws. These legal frameworks protect the identities of beneficial owners, shareholders, and account holders from public and governmental disclosure. For individuals who value discretion—whether for personal security or strategic reasons—this secrecy is a major draw.

3. Asset Protection

Tax havens often offer legal structures like trusts and foundations that protect assets from lawsuits, creditors, or political risk in the individual’s home country. These protections are especially important for celebrities, investors, or politically exposed persons who may face legal scrutiny or reputational threats.

4. Ease of International Investment

Offshore financial centers typically provide access to a range of global investment opportunities, including foreign exchange markets, offshore funds, and private equity vehicles. They often have well-developed banking and legal systems that facilitate cross-border financial transactions with fewer restrictions.

5. Flexible Corporate Structures

These jurisdictions allow the formation of entities such as shell companies, holding companies, and special purpose vehicles (SPVs) with minimal administrative requirements. These structures can be used for profit-shifting, tax planning, and managing global subsidiaries more efficiently.

6. Regulatory Arbitrage

Companies can benefit from more lenient business regulations in tax havens compared to their home countries. This includes relaxed reporting standards, lower compliance costs, and fewer restrictions on corporate governance. By operating under these favorable conditions, businesses can reduce operational and administrative burdens.

7. Inheritance and Estate Planning

Tax havens often provide exemptions or reduced rates on inheritance and estate taxes. Wealthy individuals use these jurisdictions to establish trusts or foundations that preserve their wealth and pass it on to heirs with minimal tax implications. This is a common strategy for intergenerational wealth transfer.

How Do Tax Havens Work?

How Do Tax Havens Work?

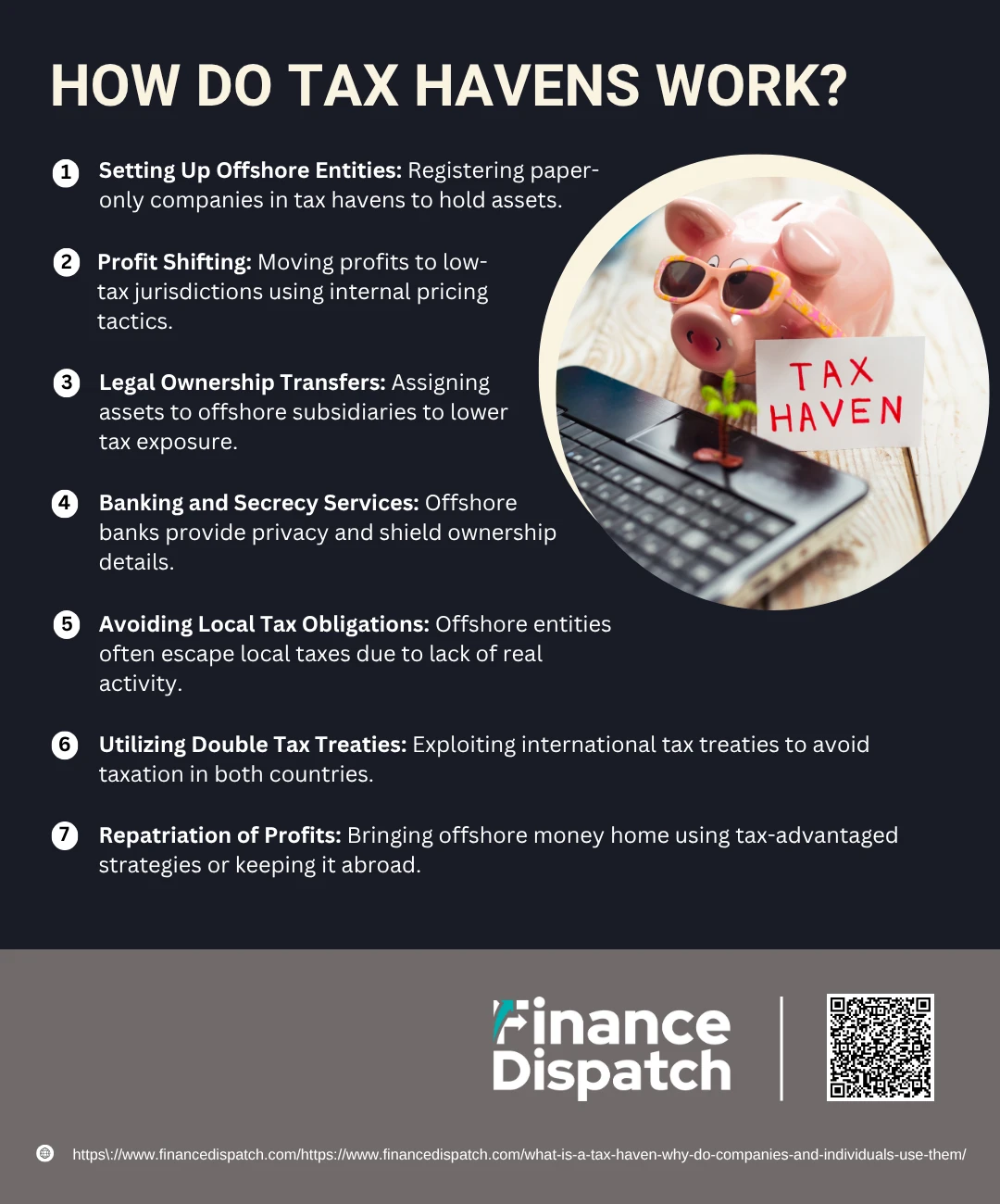

At their core, tax havens function as legal jurisdictions that help individuals and corporations reduce or eliminate taxes owed in their home countries. They achieve this by combining lenient financial regulations, minimal transparency requirements, and low or zero taxation. What makes tax havens particularly effective is that they do not require companies to conduct any real business activity within their borders. Instead, profits, assets, or intellectual property can be strategically shifted to these jurisdictions—on paper—to reduce taxable income elsewhere. Here’s a deeper look into how the system typically works:

1. Setting Up Offshore Entities

Individuals or businesses begin by registering shell companies or subsidiaries in a tax haven. These companies often have no employees, physical office, or commercial activity. They exist solely to hold assets or route income. Registration processes are usually simple and inexpensive, making them accessible even to smaller firms or investors.

2. Profit Shifting

Multinational corporations move their profits from high-tax countries to their offshore entities through tactics like transfer pricing, where internal transactions are priced to shift earnings. For example, a company might charge itself inflated licensing fees from its tax haven subsidiary, reducing taxable income in its home country while boosting profits in the tax haven.

3. Legal Ownership Transfers

Companies may transfer ownership of valuable assets—like patents, trademarks, or brand rights—to their offshore subsidiaries. This way, any revenue generated from those assets (e.g., royalties or licensing fees) is taxed in the haven jurisdiction, where the tax rate is extremely low or nonexistent.

4. Banking and Secrecy Services

Offshore banks in tax havens offer strict confidentiality. Personal identities and financial transactions are often shielded from public records and international regulators. This makes it difficult for foreign tax authorities to trace who owns what, allowing for discreet accumulation and movement of wealth.

5. Avoiding Local Tax Obligations

Since the offshore entity usually has no meaningful operations in the tax haven (no factories, employees, or customers), it avoids paying local taxes entirely. Simultaneously, the home country often can’t tax the income either, due to loopholes in international tax rules.

6. Utilizing Double Tax Treaties

Some tax havens have double taxation avoidance agreements with other countries. These treaties are meant to prevent being taxed twice on the same income. However, clever structuring can exploit these treaties to eliminate tax obligations altogether in both the source and the haven country.

7. Repatriation of Profits

Eventually, the money may be brought back to the home country through dividends, intercompany loans, or other methods—sometimes taking advantage of tax incentives or exemptions. In other cases, the money may remain offshore, continuously reinvested to avoid triggering taxable events.

Benefits of Using Tax Havens

Tax havens offer a range of financial and legal advantages that make them highly appealing to multinational corporations, high-net-worth individuals, and investors. While the use of tax havens is often surrounded by ethical debates, the fact remains that these jurisdictions provide legitimate, strategic tools for managing taxes, protecting assets, and accessing global financial markets. Here are the key benefits of using tax havens:

1. Reduced Tax Burden

The most obvious benefit is the ability to significantly lower or eliminate taxes on income, profits, capital gains, and inheritance. This helps individuals and businesses retain a larger portion of their earnings.

2. Financial Privacy and Confidentiality

Tax havens often enforce strong privacy laws that protect the identity of account holders and company owners, making them ideal for those who value financial discretion.

3. Asset Protection

Wealth stored in tax haven structures like trusts or offshore accounts can be safeguarded against lawsuits, political instability, or claims from creditors in the user’s home country.

4. Simplified Regulatory Environment

Compared to high-tax jurisdictions, tax havens usually offer fewer regulatory hurdles, making it easier and faster to set up and operate companies or investment vehicles.

5. Access to International Markets

Many tax havens serve as global financial centers, offering sophisticated banking systems, investment options, and access to international capital.

6. Estate and Succession Planning

With minimal or no estate taxes, tax havens provide efficient tools for passing wealth to future generations, preserving family fortunes over the long term.

7. Stable Political and Economic Climate

Most tax havens are known for their political neutrality and economic stability, providing a safe and predictable environment for long-term wealth preservation.

8. Favorable Legal Frameworks

These jurisdictions offer laws that are friendly to foreign investors and business owners, often providing legal protection and enforcement mechanisms that are reliable and business-oriented.

Disadvantages and Risks of Tax Havens

While tax havens offer notable financial advantages, they also come with significant drawbacks and potential risks. Their use—especially when aggressive or poorly managed—can lead to legal complications, reputational harm, and scrutiny from tax authorities. Additionally, the broader economic and ethical implications of tax havens have led to increasing international pressure for transparency and regulation. Below are some of the most important disadvantages and risks associated with tax havens:

1. Legal and Regulatory Scrutiny

Using tax havens may trigger audits, investigations, or legal action from tax authorities, especially if the activities appear to border on tax evasion rather than legal avoidance.

2. Reputational Damage

Association with offshore accounts and secretive jurisdictions can harm the public image of companies and individuals, portraying them as unethical or untrustworthy.

3. Contribution to Inequality

Tax havens benefit the wealthy and large corporations disproportionately, widening the economic gap and depriving governments of revenue for public services.

4. Risk of Policy Changes

Tax laws and treaties are evolving rapidly. A jurisdiction once considered a safe haven may face sudden regulation changes, impacting financial plans or asset security.

5. Instability in Revenue Streams

For countries relying on tax haven-related income, their revenues can be unpredictable, especially if global reforms reduce the appeal of such jurisdictions.

6. Lack of Transparency

The opaque nature of financial operations in tax havens can lead to abuse, including money laundering, tax fraud, and hiding illicit wealth.

7. Ethical and Social Backlash

As awareness grows about the social costs of tax avoidance, companies and individuals using tax havens may face boycotts, shareholder activism, or regulatory penalties.

8. Double Taxation Risk

Improper use or poor structuring of offshore entities can lead to double taxation if tax authorities reject the tax haven’s validity in income declarations.

Real-World Examples of Tax Havens

Tax havens are found across the globe and vary in terms of tax policies, secrecy laws, and regulatory frameworks. Some are small island nations offering zero-tax regimes, while others are developed countries that provide favorable corporate structures and tax treaties. These jurisdictions attract multinational corporations, celebrities, and investors looking to legally minimize their tax liabilities or safeguard assets. Below is a table highlighting some of the most well-known tax havens, their unique features, and the types of users they attract:

| Country/Jurisdiction | Key Tax Features | Primary Users |

| Cayman Islands | No corporate, income, or capital gains tax; strong financial secrecy | Investment firms, hedge funds, multinationals |

| Bermuda | 0% corporate tax; no taxes on profits, dividends, or capital gains | Insurance companies, Fortune 500 firms |

| Switzerland | Favorable tax for foreign entities; once famous for banking secrecy | Private banks, HNWIs, asset managers |

| Luxembourg | Low effective corporate taxes; extensive tax treaties | Holding companies, investment funds |

| Netherlands | Corporate tax incentives; popular for intellectual property holding structures | Tech companies, global brands |

| Singapore | Nominal corporate tax rates; tax incentives for foreign businesses | Asian HQs, e-commerce firms, exporters |

| British Virgin Islands | No corporate or capital gains tax; popular for anonymous company formations | Offshore service providers, shell companies |

| Isle of Man | No capital gains or inheritance tax; low income tax | Pension holders, investors |

| Mauritius | Low corporate tax; tax treaty benefits for India and Africa | Indian firms, African market investors |

| Ireland | Low corporate tax (12.5%); used in complex tax planning structures (e.g., Apple case) | Tech giants, pharmaceutical companies |

Legal vs. Illegal Use: Avoidance vs. Evasion

The use of tax havens falls into two broad categories—legal tax avoidance and illegal tax evasion—and understanding the difference is critical. Tax avoidance involves using legal methods to minimize tax liabilities, such as setting up subsidiaries in low-tax jurisdictions, transferring intellectual property, or utilizing tax treaties. While often controversial, avoidance operates within the framework of the law. In contrast, tax evasion involves deliberately hiding income, falsifying records, or failing to report offshore assets to evade taxes, which is a criminal offense in most countries. Many individuals and companies walk a fine line between the two, but the consequences are vastly different—avoidance may draw regulatory attention, while evasion can lead to heavy fines, reputational damage, and even prosecution.

Global Efforts to Regulate Tax Havens

As concerns over tax avoidance, money laundering, and financial secrecy have grown, governments and international organizations have launched coordinated efforts to curb the misuse of tax havens. These initiatives aim to promote transparency, close legal loopholes, and ensure fair tax practices across borders. Through legislation, international treaties, and regulatory reforms, authorities are increasing pressure on tax haven jurisdictions to comply with global standards. Here are some of the key global efforts currently in place:

1. FATCA (Foreign Account Tax Compliance Act)

A U.S. law requiring foreign financial institutions to report assets held by U.S. citizens to the IRS, improving visibility into offshore holdings.

2. CRS (Common Reporting Standard)

An OECD-led initiative where participating countries automatically exchange financial account information to prevent tax evasion.

3. BEPS (Base Erosion and Profit Shifting)

A project by the OECD and G20 aimed at closing gaps in international tax rules that allow profits to shift to low-tax jurisdictions.

4. TIEAs (Tax Information Exchange Agreements)

Bilateral or multilateral agreements between countries that enable sharing of tax-related information upon request.

5. MLATs (Mutual Legal Assistance Treaties)

Agreements that facilitate cooperation in criminal investigations, including those related to tax evasion and money laundering.

6. Blacklists and Watchlists

The EU and other global bodies publish lists of non-cooperative tax jurisdictions, pressuring them to improve transparency and compliance.

7. Economic Substance Laws

Requirements introduced in many tax havens mandating that companies have a genuine local presence and economic activity to qualify for tax benefits.

8. Corporate Transparency Regulations

Reforms such as beneficial ownership registries aim to uncover the real individuals behind shell companies and trusts.

The Future of Tax Havens

The future of tax havens is being shaped by a global push for greater transparency, tighter regulations, and more equitable tax systems. As international bodies like the OECD, G20, and Financial Action Task Force continue to implement stricter frameworks, many traditional tax havens are being forced to adapt or risk blacklisting and sanctions. New rules requiring economic substance, information sharing, and beneficial ownership disclosure are diminishing the secrecy that once defined these jurisdictions. At the same time, some tax havens are rebranding themselves as legitimate financial centers with robust compliance standards. While tax minimization strategies will likely persist, the window for aggressive tax avoidance is narrowing. Companies and individuals using offshore structures must now balance tax efficiency with increased scrutiny and legal risk, signaling that the era of unchecked financial secrecy is coming to an end.

Conclusion

Tax havens remain a powerful, though controversial, tool in the global financial system. They offer significant advantages such as reduced tax liabilities, asset protection, and financial privacy—making them attractive to corporations and wealthy individuals alike. However, the ethical, legal, and economic concerns surrounding their use cannot be ignored. The distinction between legal tax avoidance and illegal tax evasion is critical, as misuse can lead to severe consequences. With growing international efforts to enhance transparency and close regulatory loopholes, the use of tax havens is under increasing scrutiny. As the global tax landscape continues to evolve, responsible financial planning, compliance with international laws, and a strong understanding of both the benefits and risks of tax havens are more important than ever.