The insurance industry has long been associated with complex policies, lengthy paperwork, and slow claim processing. However, with the advent of InsurTech—a fusion of “insurance” and “technology”—the sector is undergoing a transformative shift. InsurTech leverages artificial intelligence (AI), big data, blockchain, and the Internet of Things (IoT) to streamline operations, enhance customer experience, and create more personalized insurance products. By integrating advanced digital solutions, InsurTech not only optimizes risk assessment and claims management but also makes insurance more accessible and cost-effective. This article explores the fundamental concepts of InsurTech, its key applications, and how it is revolutionizing the insurance landscape for both consumers and providers.

What is InsurTech?

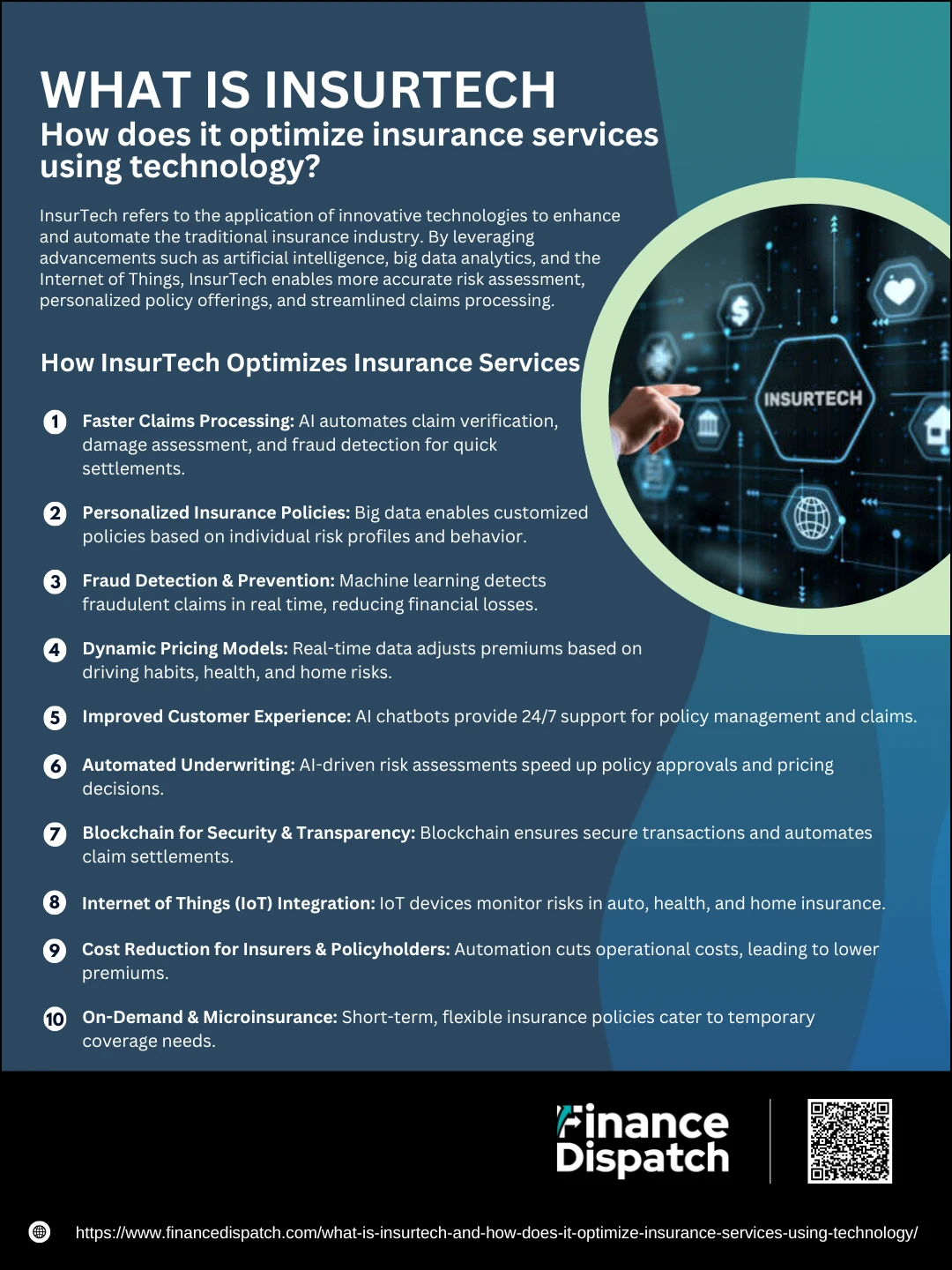

InsurTech, short for “insurance technology,” refers to the application of advanced digital solutions to improve and modernize the traditional insurance industry. It encompasses technologies such as artificial intelligence (AI), big data analytics, blockchain, machine learning, and the Internet of Things (IoT) to streamline operations, enhance customer interactions, and create more personalized insurance offerings. Unlike conventional insurance models that rely on manual processes and broad risk assessments, InsurTech utilizes data-driven insights to offer customized policies, faster claims processing, and improved fraud detection. By integrating automation and digital tools, InsurTech enables insurance companies to reduce costs, increase efficiency, and provide a seamless experience for policyholders, making insurance more accessible, transparent, and customer-centric.

How InsurTech Optimizes Insurance Services

How InsurTech Optimizes Insurance Services

The insurance industry has traditionally been known for its complex processes, extensive paperwork, and time-consuming claims management. However, with the emergence of InsurTech, the landscape is rapidly evolving, making insurance more efficient, cost-effective, and customer-centric. InsurTech leverages advanced technologies such as artificial intelligence (AI), big data, blockchain, and the Internet of Things (IoT) to streamline operations, automate processes, and enhance the overall customer experience. Here’s how InsurTech is optimizing various aspects of insurance services:

1. Faster Claims Processing

One of the biggest pain points in traditional insurance is the slow and tedious claims process. InsurTech introduces AI-driven automation that verifies claims, assesses damages, and processes payments in a fraction of the time it takes conventional insurers. Machine learning models can analyze claims data, identify inconsistencies, and prevent fraudulent claims, ensuring fair and efficient settlements.

2. Personalized Insurance Policies

Instead of offering one-size-fits-all policies, InsurTech utilizes big data analytics to create customized policies based on an individual’s specific needs. Whether it’s auto, health, or home insurance, data-driven models analyze customer behavior, lifestyle, and risk factors to provide tailored coverage that best suits their situation.

3. Fraud Detection & Prevention

Insurance fraud is a major challenge for the industry, leading to billions in losses annually. InsurTech employs machine learning algorithms to detect suspicious patterns and anomalies in claims data. AI-powered fraud detection systems analyze customer history, claim patterns, and third-party data to flag fraudulent activities in real time, reducing financial risks for insurers.

4. Dynamic Pricing Models

Traditional insurance pricing is based on static risk assessment models, but InsurTech enables dynamic pricing, adjusting premiums based on real-time data. For example:

- Auto insurance uses telematics devices to monitor driving behavior, offering lower premiums to safe drivers.

- Health insurance utilizes wearable devices to track fitness levels, rewarding policyholders for healthy lifestyles.

- Home insurance integrates smart home sensors to assess risk levels and adjust policy rates accordingly.

5. Improved Customer Experience

InsurTech companies focus on making insurance more user-friendly and accessible. AI-powered chatbots and virtual assistants provide 24/7 customer support, allowing policyholders to get instant quotes, file claims, and receive assistance without waiting for human agents. This enhances overall customer satisfaction and reduces response times.

6. Automated Underwriting

Underwriting is a crucial step in insurance, determining eligibility, coverage, and premium pricing. Traditionally, this process takes weeks due to manual risk assessments. InsurTech utilizes AI-driven underwriting tools to analyze a policyholder’s data, medical records, or driving behavior, making faster and more accurate risk assessments, reducing manual work, and enhancing decision-making.

7. Blockchain for Security & Transparency

Insurance companies handle vast amounts of sensitive customer data, making security a top priority. Blockchain technology ensures secure, tamper-proof transactions by storing data on a decentralized ledger. Smart contracts automate policy execution, ensuring that claims are processed instantly when pre-defined conditions are met—eliminating fraud and increasing transparency between insurers and policyholders.

8. Internet of Things (IoT) Integration

IoT devices play a critical role in risk assessment by continuously monitoring real-world conditions. Some key applications include:

- Auto insurance: Telematics devices track driving behavior (speed, braking, mileage) to determine insurance rates.

- Health insurance: Wearables like Fitbit and Apple Watch track physical activity and heart rate for customized premiums.

- Home insurance: Smart home devices detect leaks, smoke, or security breaches, preventing damage and lowering risk.

9. Cost Reduction for Insurers & Policyholders

By automating processes and reducing operational inefficiencies, InsurTech significantly lowers costs for both insurers and policyholders. Paperwork, manual assessments, and human-driven errors are minimized, reducing administrative expenses. With better risk evaluation and fraud prevention, insurers can offer lower premiums and more affordable coverage.

10. On-Demand & Microinsurance

Traditional insurance policies often require long-term commitments, making them unsuitable for temporary or short-term needs. InsurTech has introduced on-demand and microinsurance solutions, allowing customers to purchase short-term, event-based insurance coverage as needed. Examples include:

- Travel insurance for a single trip

- Rental car coverage for a few days

- Gadget insurance for specific devices

- Freelancer health insurance on a per-project basis

How InsurTechWork?

How InsurTechWork?

The insurance industry has long been characterized by paper-heavy processes, slow claims handling, and standardized policy pricing. However, InsurTech is disrupting the sector by integrating advanced technologies like artificial intelligence (AI), big data analytics, blockchain, and the Internet of Things (IoT) to improve efficiency, reduce costs, and enhance customer experience. By leveraging these innovations, insurance companies can now offer more accurate risk assessments, faster claim settlements, and customized policies tailored to individual needs.

How InsurTech Works: Key Technologies and Processes

1. AI-Powered Automation

Artificial intelligence automates routine tasks such as policy underwriting, claims processing, and customer support. AI-driven chatbots handle inquiries and policy changes, reducing human intervention and speeding up response times.

2. Big Data Analytics

InsurTech companies collect and analyze massive amounts of customer data from various sources, including social media, transaction histories, and connected devices, to assess risks more accurately, offer personalized policies, and detect fraudulent activities.

3. Blockchain & Smart Contracts

Blockchain technology ensures secure, tamper-proof transactions while smart contracts automate claim settlements by executing payments once predefined conditions are met, reducing processing delays and fraudulent claims.

4. IoT Integration

Devices like telematics in vehicles, wearable health trackers, and smart home sensors provide real-time data to insurers. This helps auto insurers adjust premiums based on driving behavior, health insurers customize coverage based on fitness levels, and home insurers monitor risks like fire or water leaks.

5. Machine Learning for Fraud Detection

Insurers use machine learning algorithms to detect unusual patterns and anomalies in claims data. By analyzing vast datasets, AI can identify and prevent fraudulent claims before they are processed.

6. On-Demand & Usage-Based Insurance

InsurTech enables flexible pay-as-you-go insurance models where customers only pay for coverage when they need it. For example, short-term travel insurance, gig economy worker protection, or auto insurance based on miles driven.

7. Predictive Analytics for Risk Management

Insurers leverage predictive analytics to forecast risks and set fair pricing models based on historical data and customer behavior. This helps in offering lower premiums for safer drivers or healthier individuals.

8. Cloud Computing for Scalability

Cloud-based platforms allow secure, scalable data storage and processing, making it easier for insurers to handle large volumes of claims, customer interactions, and policy management with real-time access.

Key Technologies Powering InsurTech

InsurTech is revolutionizing the insurance industry by leveraging advanced digital technologies to streamline processes, enhance risk assessment, and improve customer experience. Traditional insurance models often rely on manual underwriting, standardized pricing, and lengthy claims processing, but InsurTech uses AI, big data, blockchain, and IoT to automate tasks, personalize coverage, and ensure security. These technologies increase efficiency, reduce costs, and create more flexible and customer-centric insurance solutions. The table below highlights the key technologies driving the InsurTech revolution and their impact on the industry.

Key Technologies in InsurTech and Their Impact

| Technology | Function in InsurTech | Impact on the Industry |

| Artificial Intelligence (AI) | Automates underwriting, claims processing, and customer interactions through AI-powered chatbots. | Reduces processing time, improves efficiency, and enhances customer experience. |

| Big Data & Analytics | Gathers and analyzes large datasets to assess risk, detect fraud, and optimize pricing. | Enables personalized insurance policies and improves risk assessment accuracy. |

| Blockchain & Smart Contracts | Creates tamper-proof records of transactions and automates policy execution with smart contracts. | Enhances security, transparency, and efficiency in claims processing. |

| Internet of Things (IoT) | Uses telematics, wearables, and smart home devices to monitor risk factors in real-time. | Allows dynamic pricing, reduces fraudulent claims, and promotes preventive risk management. |

| Machine Learning (ML) | Identifies patterns in data to detect fraudulent claims and improve risk predictions. | Minimizes fraud, refines risk assessment, and enables predictive analytics. |

| Cloud Computing | Stores and processes large amounts of insurance data securely on scalable cloud platforms. | Improves accessibility, enhances data security, and reduces infrastructure costs. |

| Telematics | Tracks vehicle usage and driving behavior through connected devices. | Enables usage-based insurance (UBI), rewarding safe drivers with lower premiums. |

| Drones & Computer Vision | Assesses property damage using aerial imagery and AI-based analysis. | Speeds up damage assessments, improves claim accuracy, and reduces manual inspections. |

Benefits of InsurTech for Policyholders and Insurers

Benefits of InsurTech for Policyholders and Insurers

The adoption of InsurTech is transforming the insurance sector by enhancing efficiency, personalization, and security. Traditional insurance models, known for slow claims processing, rigid policy structures, and complex paperwork, are now being replaced by automated, data-driven solutions. Policyholders enjoy more customized coverage, quicker payouts, and transparent transactions, while insurers benefit from reduced fraud, lower operational costs, and improved risk assessment. Here’s how InsurTech is benefiting both policyholders and insurers.

Benefits for Policyholders

1. Faster Claims Processing

AI-powered automation helps verify claims, assess damages, and process payouts in minutes instead of weeks. Machine learning models analyze claims data, reducing delays and errors.

2. Personalized Insurance Plans

Instead of generic policies, InsurTech uses big data analytics to offer customized policies based on lifestyle, behavior, and individual risk factors, ensuring fairer and more relevant pricing.

3. Lower Premiums with Usage-Based Insurance (UBI)

IoT devices such as telematics for auto insurance, wearables for health insurance, and smart home sensors allow policyholders to receive discounts for safe driving, healthy habits, or reduced home risks.

4. Convenient Self-Service Platforms

InsurTech companies provide mobile apps and AI-powered chatbots, enabling users to purchase policies, update details, submit claims, and get assistance without visiting an office or calling an agent.

5. Greater Transparency in Policies & Transactions

Blockchain technology secures policy details, transactions, and claims in tamper-proof digital records, reducing hidden fees and improving trust between insurers and policyholders.

6. Improved Customer Experience

Digital-first insurance platforms streamline policy purchases and claims without extensive paperwork or agent involvement, providing a seamless, user-friendly experience.

7. On-Demand & Microinsurance Options

Policyholders can purchase short-term, event-based coverage (e.g., travel insurance for a single trip, gadget insurance, or temporary auto insurance), offering cost-effective flexibility.

8. Fraud Prevention & Security

AI-driven fraud detection ensures that genuine claims are processed quickly, while fraudulent ones are identified and flagged, improving fairness and reducing financial losses.

Benefits for Insurers

1. Enhanced Risk Assessment

By leveraging big data analytics, insurers can assess customer risk profiles more accurately, resulting in better pricing strategies and improved profitability.

2. Reduced Operational Costs

Automation and AI-driven workflows eliminate redundant administrative tasks, cutting costs associated with manual underwriting, claims processing, and customer service.

3. Fraud Detection & Prevention

Machine learning algorithms analyze claims data to detect inconsistencies, unusual patterns, and potential fraud, reducing financial losses.

4. Dynamic Pricing Models

With real-time data from IoT devices, insurers can implement flexible, behavior-based pricing, rewarding low-risk policyholders with lower premiums while ensuring higher-risk customers pay fair rates.

5. Increased Customer Retention & Satisfaction

Faster claims processing, personalized policies, and improved digital experiences lead to higher customer satisfaction and loyalty, reducing churn rates.

6. Scalability & Efficiency with Cloud Computing

Cloud-based systems provide secure, scalable data storage, allowing insurers to manage large volumes of policies, claims, and customer interactions more efficiently.

7. Automated Underwriting

AI-driven underwriting tools analyze customer data, health records, driving habits, and financial history to determine risk levels and premium costs, making policy approvals quicker and more accurate.

8.Regulatory Compliance & Security

Blockchain ensures compliance with insurance regulations, maintaining transparent and immutable records of transactions, preventing data tampering, and reducing legal risks.

Challenges and Risks in InsurTech

Challenges and Risks in InsurTech

While InsurTech is revolutionizing the insurance industry with automation, artificial intelligence (AI), big data, and blockchain, it also comes with challenges and risks that insurers and policyholders must navigate. The rapid adoption of digital solutions introduces security vulnerabilities, regulatory hurdles, and operational complexities that can impact the industry’s stability. InsurTech companies must balance innovation with compliance, cybersecurity, and consumer trust to ensure long-term success. Below are the key challenges and risks facing the InsurTech sector.

Key Challenges and Risks in InsurTech

- Data Privacy & Security Concerns – The use of big data and AI exposes sensitive customer information to cyber threats, increasing risks of data breaches, hacking, and identity theft.

- Regulatory & Compliance Issues – InsurTech companies must adhere to complex local and international insurance laws, which vary by region and require strict compliance.

- Fraud & Cybercrime Risks – As insurance moves online, fraudulent claims, fake identities, and cyberattacks pose a significant threat to insurers.

- High Implementation Costs – Developing and integrating AI, blockchain, and IoT requires significant investment, making it challenging for smaller firms to compete.

- Resistance from Traditional Insurers – Many legacy insurance providers are reluctant to adopt digital transformation, slowing the industry’s progress.

- Balancing Automation & Human Touch – While AI chatbots and automated underwriting improve efficiency, they may reduce personalized customer service, leading to dissatisfaction.

- Technology Integration Challenges – Many InsurTech firms struggle with integrating modern solutions into existing legacy systems, causing operational inefficiencies.

- Algorithmic Bias & Fairness Issues – AI-based underwriting and risk assessments may be biased, leading to unfair pricing or discrimination in policy approvals.

- Market Competition & Scalability – The growing number of InsurTech startups creates high competition, making it difficult for new entrants to scale and gain market share.

- Lack of Consumer Awareness & Trust – Many customers are still hesitant to adopt digital insurance solutions, fearing privacy issues and lack of transparency.

Future Trends in InsurTech

The future of InsurTech is set to be driven by continuous technological advancements, evolving consumer expectations, and increasing regulatory changes. Emerging technologies like artificial intelligence (AI), blockchain, and the Internet of Things (IoT) will further revolutionize the industry, enabling hyper-personalized insurance policies, real-time risk assessment, and automated claims processing. The rise of usage-based insurance (UBI), on-demand coverage, and peer-to-peer insurance models will cater to modern, digital-first consumers who demand flexibility and transparency. Additionally, predictive analytics and big data will enhance fraud detection and underwriting accuracy, reducing costs for insurers while improving customer satisfaction. Embedded insurance solutions—where coverage is seamlessly integrated into digital purchases—will become more common, offering effortless protection in real-time transactions. As cybersecurity threats grow, the industry will also invest in enhanced data security measures to protect consumer information. In the coming years, InsurTech will continue to reshape the insurance landscape, making coverage more accessible, efficient, and customer-centric.

Conclusion

InsurTech is reshaping the insurance industry by leveraging advanced technologies such as AI, big data, blockchain, and IoT to enhance efficiency, transparency, and customer experience. From automated claims processing and personalized policies to fraud prevention and dynamic pricing models, InsurTech is making insurance more accessible, cost-effective, and user-friendly. While challenges like data security, regulatory compliance, and technology integration remain, the industry is continuously evolving to address these concerns. As consumer expectations shift toward digital-first solutions, InsurTech will play a pivotal role in the future of insurance, driving innovation, reducing operational costs, and providing more tailored coverage options. The continued adoption of smart automation, predictive analytics, and embedded insurance models will ensure that insurance remains relevant, efficient, and responsive to the needs of modern policyholders and insurers alike.